- Green Digest

- Posts

- What's Happening in Sustainability & ESG (Week Recap 21.10 - 27.10) 🌎

What's Happening in Sustainability & ESG (Week Recap 21.10 - 27.10) 🌎

The EU’s one step forward, two steps back dance continues

This week’s read time: 8 minutes

Welcome to this edition of Green Digest, where you will get updated about everything happening in the Sustainability & ESG space in less than 10 minutes. 🌎

We go through tons of articles and data from the most reliable sources, filter & simplify them, and serve them to you in bite-sized chunks every week. 🍀

In this edition, we’ll cover:

• The EU’s one step forward, two steps back dance continues - last week’s key developments 🇪🇺

• The GHG Protocol released its first draft update in a decade, tightening rules on how companies report emissions from purchased energy 📑

• Sustainability reporting is now nearly universal among US public firms, with 99% of the S&P 500 and 94% of the Russell 1000 issuing ESG reports in 2024 🇺🇸

• Norway’s $2 trillion wealth fund released its 2030 Climate Plan to align 8,500 companies with net zero by 2050, favoring engagement over divestment 🇳🇴

• ExxonMobil filed a lawsuit against California, claiming that the state’s new climate disclosure laws violate the First Amendment rights 🇺🇸

• and other news 🌍

PRESENTED BY TERRA REPORTING

Future-Proof ESG Reporting at Scale:

How the Port of Antwerp-Bruges (PoAB) Leads the Way

The CSRD is reshaping how large organisations collect, manage, and disclose ESG data. As one of Europe’s largest, most strategically located, and forward-thinking maritime and logistics hubs, Port of Antwerp-Bruges (PoAB) needed to implement a reliable and scalable reporting process to manage data from 11 legal entities and over 800 data points.

That’s why PoAB turned to Microsoft Cloud for Sustainability, powered by the Terra ESG Platform, to automate data collection, streamline integration, and ensure full CSRD compliance, all while advancing their mission toward climate neutrality by 2050.

In this story, you’ll learn how PoAB:

✅ Automated ESG data collection and validation across entities

✅ Integrated systems using Microsoft Cloud for Sustainability

✅ Simplified CSRD compliance and enhanced reporting accuracy

✅ Gained real-time insights to drive progress toward net zero

About Terra Reporting:

Built on Microsoft Cloud for Sustainability, the Terra ESG Platform helps organisations automate ESG & Sustainability data management, streamline CSRD reporting, and transform sustainability into measurable business value.

Best Regards,

The Terra Reporting Team

THIS WEEK’S TOP NEWS

Regulatory Oversight & Industry Insights

Omnibus deal rejected by the EU Parliament

The European Parliament narrowly rejected a compromise deal on its position for the EU Commission’s Omnibus I package, prolonging uncertainty over potential rollbacks to the EU’s sustainability and due diligence rules. The proposal, defeated 318 to 309, sought cuts to the CSRD and CSDDD, keeping a 1,000 employee threshold for CSRD and raising the CSDDD scope to 5,000 employees and €1.5 billion in revenues. Its rejection sends the initiative back to negotiations, delaying talks with the EU Council and exposing deep divisions between those seeking limited simplifications and others pushing for sweeping deregulation. A new vote is scheduled for November 13.

US and Qatar warn over CSDDD

Political and external pressure on the EU’s due diligence agenda is mounting. The US and Qatar issued a joint letter to EU leaders warning that the CSDDD could damage trade and energy ties unless it is repealed or significantly weakened. Signed by the US Energy Secretary and Qatar’s Energy Minister, the letter claimed the directive would “seriously undermine” global energy cooperation and threaten LNG competitiveness and affordability in Europe. Despite Brussels’ attempt to scale the law back, Washington and Doha said the revisions “fall grossly short” of addressing their concerns, warning that enforcement could “jeopardize future energy investments and supply security.”

Revisions to the EU Deforestation Regulation

The European Commission unveiled revisions to the EU Deforestation Regulation (EUDR), softening due diligence requirements for retailers, manufacturers, and SMEs in low risk countries. The updated draft grants large firms a six month grace period and delays enforcement for smaller companies until late 2026, simplifying compliance by requiring only one due diligence submission per supply chain instead of multiple. The move signals a wider shift toward easing administrative burdens as businesses voice concerns over costs and complexity.

Brussels weighs flexibility in 2040 climate target

Brussels is seeking to temper its 2040 climate target amid growing tension between ambition and competitiveness. The EU aims to enshrine a 90% net emission reduction goal by 2040 ahead of COP30, but disagreements over financing and industrial impact have stalled progress. A new draft would allow the target to be reviewed every two years and prevent certain sectors such as forestry or carbon removals from being forced to compensate for others’ underperformance. While the 90% target and 3% foreign credit allowance remain, the debate underscores the EU’s balancing act between climate leadership and economic pragmatism, with concessions on carbon pricing and the 2035 combustion engine ban also under discussion.

PRESENTED BY SANDHYA SABAPATHY

A new book for leaders shaping a just climate future

In Burn Bright, Build Slow, Sandhya Sabapathy argues that the most effective climate solutions are not only fast or scalable but also just, resilient, and deeply human. Drawing on over a decade of studying and working in the space, and on interviews with executives, educators, and policy leaders across the globe, she shows how fragile systems collapse under pressure while those built with inclusion, resilience, and transparency endure and outperform. Pre-order your copy today

MORE INTERESTING NEWS

Latest developments, reports, insights, and trends

📑 The Greenhouse Gas (GHG) Protocol released a draft update to its Scope 2 Guidance (the first in a decade) introducing stricter rules for how companies account for emissions from purchased energy. The updates aim to improve accuracy and consistency in how companies measure and report emissions from purchased electricity, steam, heat, and cooling, introducing new rules for renewable energy contracts, “Scope 2 Quality Criteria,” and hourly matching requirements to align reported emissions with when and where electricity is consumed. The revisions seek to modernize reporting amid evolving energy systems and ensure continued alignment with major standards such as the ISSB and ESRS, with feedback open until December 19.

📑 The G&A Institute’s 2025 Sustainability Reporting in Focus report shows sustainability disclosure has become nearly universal among US public companies, with 99% of the S&P 500 and 94% of the Russell 1000 publishing ESG reports in 2024. Mid-cap firms saw the fastest adoption, reaching 90%, while leading frameworks like SASB (82%) and TCFD (65%) remain dominant, alongside growing use of GRI, ISSB, ESRS, and TNFD standards. Despite political and regulatory uncertainty, corporate reporting continues to expand, driven by investor demand, California’s new disclosure laws, and global harmonization efforts. The study highlights that ESG reporting is now a strategic business imperative, enhancing transparency, stakeholder trust, and preparedness for the upcoming wave of mandatory sustainability disclosures in 2026.

🇺🇸 ExxonMobil filed a lawsuit against California, claiming that the state’s new climate disclosure laws violate the First Amendment rights by forcing it to endorse “ideas with which it disagrees.” The oil giant is challenging Senate Bills 253 and 261, which require large companies to report their full GHG emissions and disclose climate-related financial risks starting in 2026. Exxon argues the laws are misleading, conflict with federal securities regulations, and undermine its voluntary reporting framework. Supported by firms like Apple and Microsoft but opposed by business groups, the laws mark California’s latest effort to mandate corporate climate transparency, now facing a legal test from one of the world’s largest emitters.

🇳🇿 New Zealand announced major revisions to its climate-related disclosure (CRD) rules, easing compliance for smaller companies and reducing liability for directors. The reporting threshold for listed issuers will rise from $60 million to $1 billion in market cap or debt value, halving the number of entities required to report. Managed investment schemes will be excluded, and directors will no longer face personal liability for breaches, though misleading disclosures remain punishable. The government cited high compliance costs (up to $2 million per firm), and declining market listings as reasons for reform, with updated legislation expected in 2026.

WHAT ARE COMPANIES DOING?

Corporate sustainability, new tools and services & companies in the news

⚖️ A French court ruled against TotalEnergies in a landmark greenwashing case, finding that its website claims about being “a major player in the energy transition” and achieving carbon neutrality by 2050 were likely to mislead consumers. The Paris Judicial Court ordered the company to remove multiple sustainability statements within a month or face fines of €10,000 per day, and to publish a link to the ruling on its website. The case marks the first time a court has declared an oil major’s net zero and transition messaging unlawful. The company accepted the ruling without appeal and will update its website with factual details on its transition efforts.

⚡️ Google formed a landmark partnership with Low Carbon Infrastructure (LCI) to build a 400 MW natural gas power plant in Illinois with carbon capture and sequestration (CCS) technology, a first-of-its-kind corporate agreement. The Broadwing Energy project will capture about 90% of its CO₂ emissions, with Google purchasing most of its power to meet data center demand. The collaboration seeks to prove CCS as a scalable, low-carbon, and commercially viable energy solution in the US.

🟢 Clean iron producer Electra announced new purchase agreements with major steelmakers and an Environmental Attribute Credit (EAC) deal with Meta to help decarbonize industrial supply chains. The Colorado-based company’s electrochemical process refines iron ore at low temperatures using renewable energy instead of coal, producing 99% pure iron while reducing waste and allowing the use of lower-grade ores.

🤝🏻 Diligent and Persefoni announced a strategic partnership to integrate their platforms and enhance corporate sustainability reporting capabilities. Under the agreement, Diligent will transition its carbon accounting clients to Persefoni’s AI-powered platform and take an equity stake in the company, combining Diligent’s governance, risk, and compliance expertise with Persefoni’s advanced carbon management and disclosure tools.

EVERYTHING FINANCE

Sustainable finance, funding rounds, acquisitions & private equity deals

Credit: Norges Bank Investment Management

🇳🇴 Norway’s $2 trillion sovereign wealth fund released it's 2030 Climate Action Plan, reaffirming its goal to align all 8,500 portfolio companies with net-zero emissions by 2050, emphasizing engagement over divestment despite a growing US backlash against climate policies. The fund said it will intensify scrutiny of companies’ climate lobbying, vote against boards when necessary, and file shareholder proposals to push for stronger action. CEO Nicolai Tangen defended the approach as essential to protecting the fund’s assets, noting “climate risk is financial risk.”

It will focus on five priorities: linking investment and climate objectives, engaging companies on Scope 1–3 targets, strengthening global disclosure standards, integrating nature and physical risk, and embedding AI-driven analytics. Since 2022, financed emissions fell 5%, carbon intensity 11%, and the share of companies with science-based targets rose from 12% to 34%. The plan also includes stress-testing portfolios, expanding renewable infrastructure, and maintaining transparency and adaptability amid policy and technology uncertainty.

📈 Mirova announced it secured €1.2 billion in commitments at the second close of its Mirova Energy Transition 6 (MET6) fund. Launched in 2023, MET6 focuses on renewable energy, energy storage, low-carbon mobility, and efficiency projects across OECD countries. The fund has already invested €960 million in 10 projects, including major renewable portfolios and e-mobility ventures, with over 300 additional opportunities worth €18 billion under review.

📈 BNP Paribas Asset Management launched the BNPP Environmental Infrastructure Income Fund, an Article 9 SFDR-classified fund focused on sustainable investments in global environmental infrastructure. The fund will hold 70–90 diversified positions across power and digital infrastructure, water and waste management, and transportation infrastructure, primarily in Europe and the US. Targeting defensive, non-cyclical assets, the fund will avoid fossil fuel-related projects and instead focus on companies benefiting from rising demand for clean energy, grid upgrades, and resilient infrastructure.

📊 ISS Sustainability Solutions, part of ISS STOXX, launched Real Asset Climate Solutions, a new suite of tools to help investors assess and mitigate climate risks across their portfolios. Key features include Geospatial Asset Analytics to model risks like floods, wildfires, and heatwaves under IPCC scenarios, as well as tools for carbon footprinting and scenario-based emissions benchmarking.

Funding rounds

🟢 Clean power startup Arbor Energy raised $55 million in Series A funding to advance its next-generation supercritical CO₂ turbine technology for clean, reliable baseload power. Founded in 2022 by former SpaceX engineers, Arbor uses oxy-combustion and sCO₂ systems to produce zero-emission or even carbon-negative electricity when powered by biomass.

🌾 TRACT raised €18.6 million in Series A funding to scale its supply chain intelligence platform for the global agrifood industry. TRACT helps major food and commodity firms map supply chains, assess sourcing risk, and ensure traceability amid growing regulatory and climate pressures.

⚡️ XNRGY Climate Systems raised new growth equity from BlackRock and other investors to scale its sustainable cooling technologies for data centers and critical infrastructure. Founded in 2017, the Arizona-based company develops energy- and water-efficient liquid and air-cooling systems for hyperscale data centers and advanced manufacturing.

Did you like today's newsletter? |

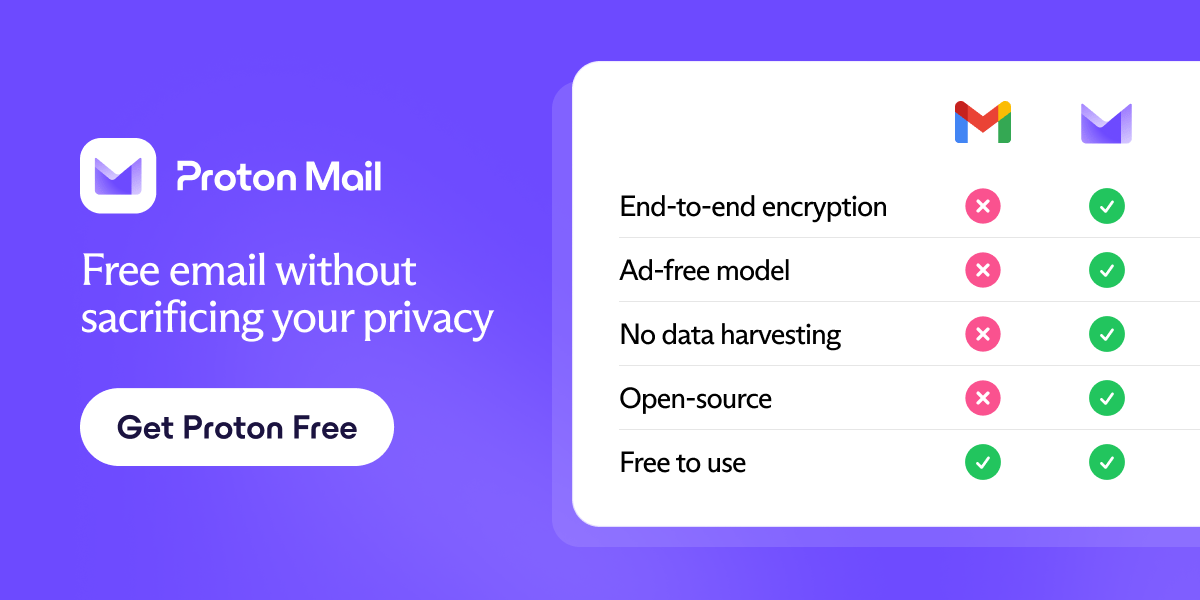

Free email without sacrificing your privacy

Gmail tracks you. Proton doesn’t. Get private email that puts your data — and your privacy — first.

PARTNER WITH US

Increase your brand awareness and visibility by reaching the right audience and target market. Showcase your company, solutions, services, products, reports, surveys, events, or other content in front of our highly targeted audience of +5,000 Sustainability & ESG professionals. Contact us at [email protected] if you think we can partner in some way.

Seeking impartial news? Meet 1440.

Every day, 3.5 million readers turn to 1440 for their factual news. We sift through 100+ sources to bring you a complete summary of politics, global events, business, and culture, all in a brief 5-minute email. Enjoy an impartial news experience.