- Green Digest

- Posts

- What's Happening in Sustainability & ESG (Week Recap 18.11 - 24.11) 🌎

What's Happening in Sustainability & ESG (Week Recap 18.11 - 24.11) 🌎

Patagonia's new standard for transparency, COP30 outcomes, and other news

Today’s newsletter is brought to you by

This week’s read time: 8 minutes

Welcome to this edition of Green Digest, where you will get updated about everything happening in the Sustainability & ESG space in less than 10 minutes. 🌎

We go through tons of articles and data from the most reliable sources, filter & simplify them, and serve them to you in bite-sized chunks every week. 🍀

In this edition, we’ll cover:

• Patagonia set a new bar for transparency in sustainability reporting, replacing polished narratives with honesty and real-world challenges 📑

• COP30 ended with a weak compromise: wealthy countries agreed to triple adaptation finance, but negotiators dropped key demands, including any plan to shift away from fossil fuels 🌎

• A US appeals court paused California’s new climate-risk reporting law (SB 261) but allowed the state’s emissions disclosure law (SB 253) to proceed 🇺🇸

• EU countries agreed to delay the deforestation regulation by one year and added a clause allowing the law to be reopened for changes by April 2026 🇪🇺

• and other news 🌍

PRESENTED BY CARBMEE

Carbmee Invites Industry Leaders to the Global Decarbonization Forum 2026 — Turning Data into Decisive Climate Action

Carbmee invites sustainability, procurement, and finance leaders to join the Global Decarbonization Forum 2026 - the premier event for driving measurable impact across industries.

Discover how leading enterprises turn data into decisive climate action and shape the next era of low-carbon value chains.

Be among the first to register for free with code 2026DECARB_FirstMover!

THIS WEEK’S TOP NEWS

Regulatory Oversight & Industry Insights

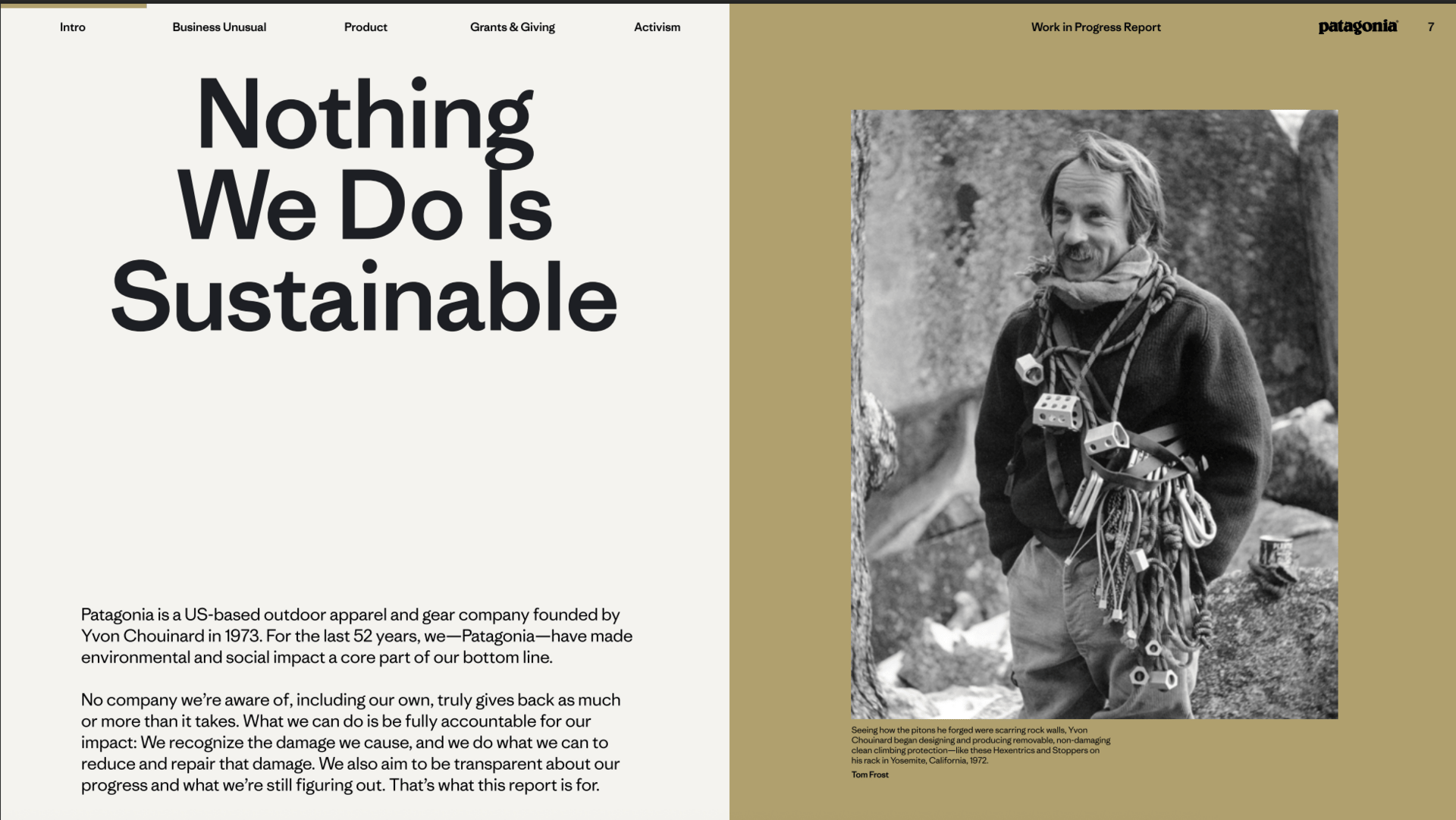

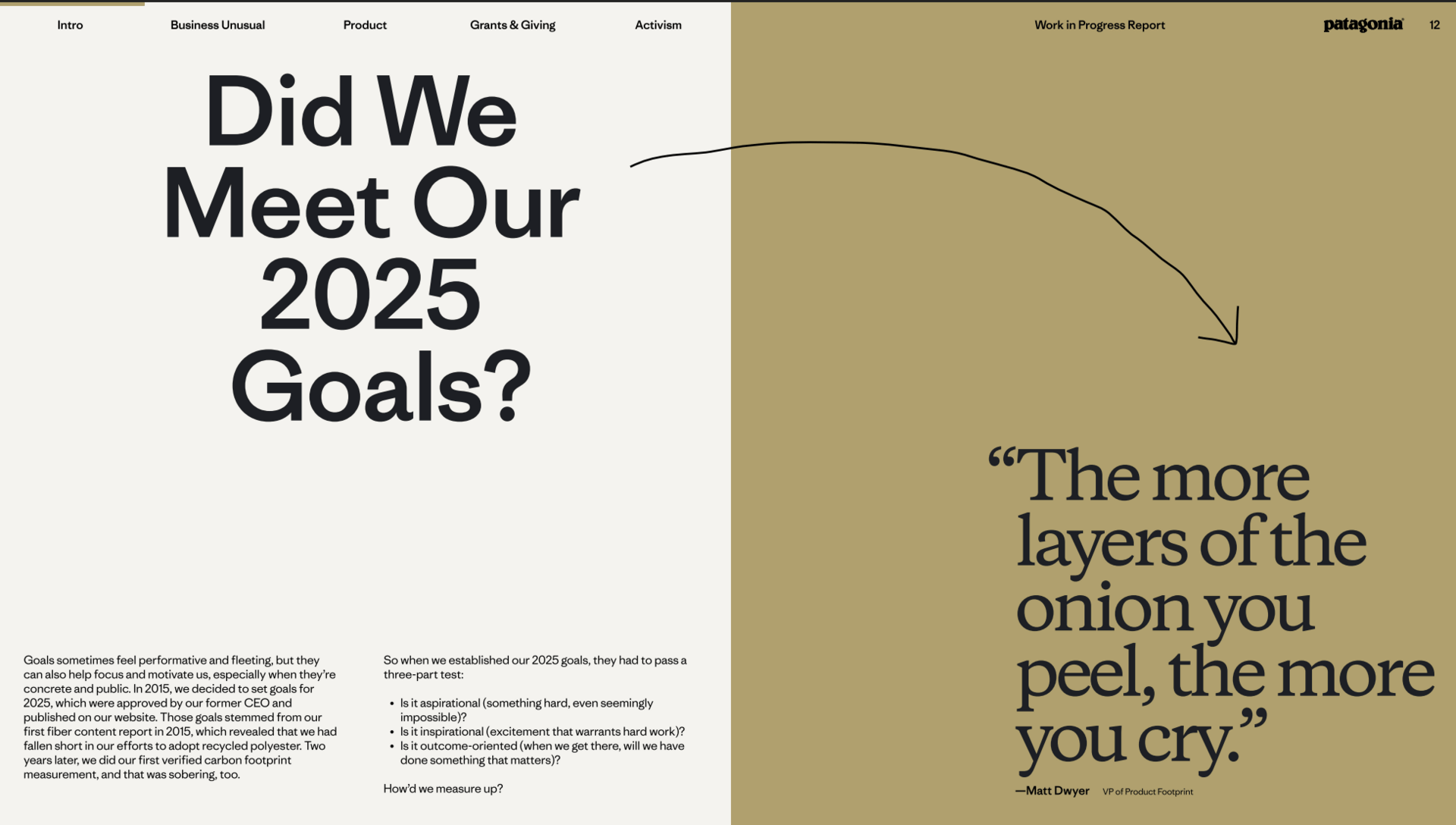

📑 Patagonia’s first “Work in Progress” impact report broke sharply from traditional corporate sustainability reports by focusing not on glossy achievements but on the company’s biggest unresolved challenges, especially across its global supply chain. Instead of relying on the usual marketing tone, Patagonia centered its report on the tensions, risks, and shortcomings in its operations, voluntarily embracing a double-materiality assessment, European-level disclosure standards, and an unusually detailed 16-page examination of human rights issues. The company openly discusses topics most brands avoid, including migrant worker fees, gaps in supply-chain oversight, and the limits of its own visibility, while crediting groups like the Fair Labor Association for independently validating its findings.

A snapshot from Patagonia’s Progress Report | Credit: Patagonia

This transparent, self-critical approach has resonated widely, offering stakeholders the honesty and accountability they increasingly demand in an era of greenwashing and rising skepticism. By publicly acknowledging what it doesn’t yet have under control and demonstrating how it studies, verifies, and responds to systemic problems, Patagonia provides a rare “x-ray” view of modern outsourcing risks and sets a new benchmark for credible sustainability communication. Rather than claiming perfection, the company tries to build trust by showing where it is struggling, what it is learning, and how it intends to change.

A snapshot from Patagonia’s Progress Report | Credit: Patagonia

The report lays out a candid picture of a company making real strides while still struggling with the hardest parts of decarbonization. Despite major gains in shifting to lower-impact “preferred materials,” Patagonia’s overall emissions rose 2% in FY2025, driven largely by a move toward more carbon-intensive packs and duffels. With raw materials and manufacturing responsible for 92% of its footprint, Patagonia now needs to cut emissions by about 10% every year to stay on track for its 2040 net-zero goal.

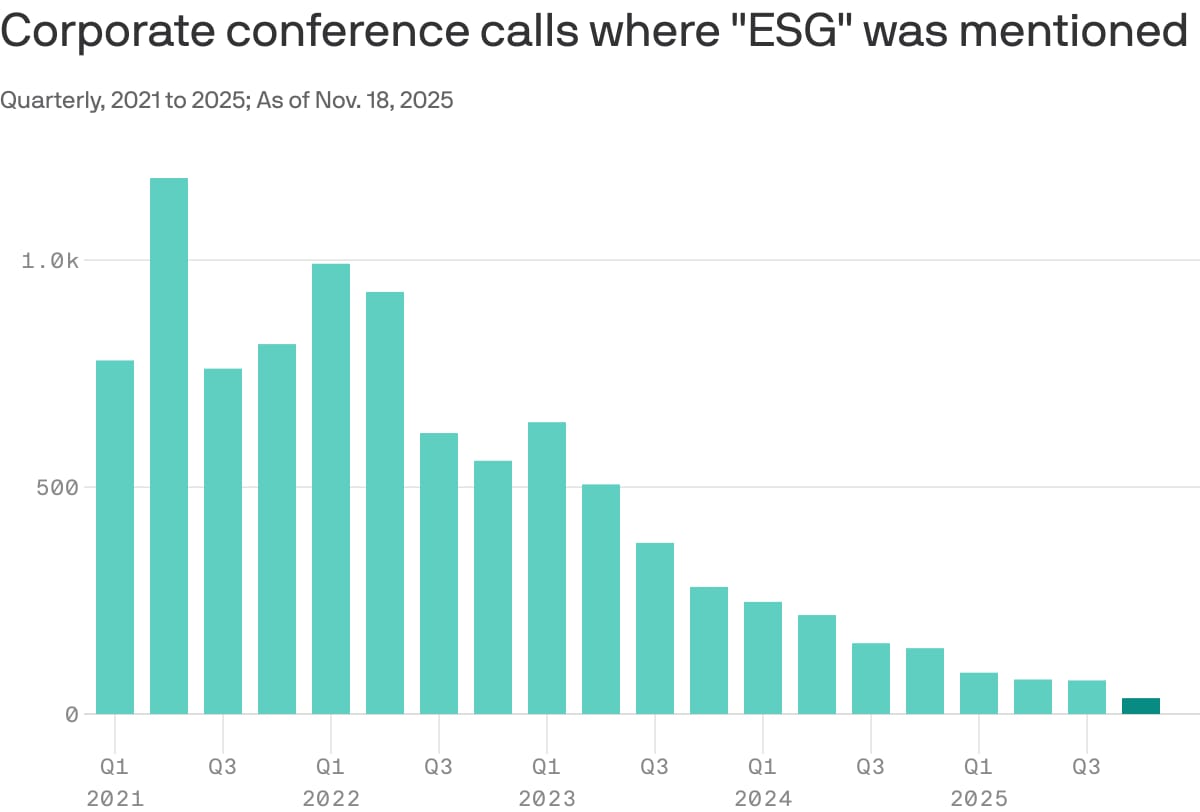

The report also underscores Patagonia’s unusual governance model and its decision to publish voluntarily in an era of rising greenhushing. The company’s report arrives at a moment when most US companies are doing the opposite - toning down their ESG language, shortening disclosures, and shifting to more cautious “sustainability” or “impact” framing as politics and global rules tighten.

Source & Credit: Axios

MORE INTERESTING NEWS

Latest developments, reports, insights, and trends

A snapshot from the COP30 closing plenary meeting | Credit: COP30

🌎 COP30 ended with a weak compromise: wealthy countries agreed to triple adaptation finance, but negotiators dropped key demands, including any plan to shift away from fossil fuels. Oil-producing nations blocked fossil-fuel language, leaving only a voluntary roadmap, while global unity faltered as countries abandoned stronger emissions targets and the US skipped the talks. China quietly asserted influence, and developing nations like India and South Africa pushed harder. Despite $9.5 billion in forest funding, the summit failed to secure a zero-deforestation roadmap or protections for Indigenous lands. The final text also softened recognition of climate science, no longer naming the IPCC as the “best available science,” further weakening the outcome.

US corporate presence surged despite Washington’s political retreat

60 Fortune 100 representatives attended the Belém summit, up from 50 in Baku. Major firms like Microsoft, Google, GM, Citi and Occidental showed up, with business leaders saying participation is driven by economic self-interest, not politics, as extreme weather raises costs and clean-energy investments accelerate globally. Experts said the strong US presence signals to global markets that the world’s largest economy still sees competitiveness and resilience in the energy transition, even as COP30’s final deal fell short of expectations.

Turkey will host COP31, Australia will lead the negotiations

Turkey will host COP31 next year, while Australia will lead the negotiations under a compromise deal reached at COP30, resolving a long-running standoff between the two countries over hosting rights. Turkey will stage the summit in Antalya, aiming for a global focus, while Australia’s Chris Bowen will handle negotiation powers, including preparing draft text and appointing facilitators.

🇺🇸 A US appeals court paused California’s new climate-risk reporting law (SB 261) but allowed the state’s emissions disclosure law (SB 253) to proceed. The injunction halts SB 261’s requirement for companies over $500 million in revenue doing business in California to publish climate-risk reports by January 1, 2026, following a challenge from the US Chamber of Commerce, which argues the law violates companies’ First Amendment rights. The court declined to block SB 253, meaning companies with over $1 billion in revenue must still begin reporting Scope 1 and 2 emissions in 2026 and Scope 3 in 2027. An appeal hearing on SB 261 is scheduled for January 2026.

🇪🇺 EU countries agreed to delay the deforestation regulation by one year and added a clause allowing the law to be reopened for changes by April 2026. The deal, backed by most member states except Belgium, the Netherlands, and Spain, would shift due diligence obligations solely to operators placing products on the market, while downstream companies would only pass on reference numbers. Parliament and the Council must finalize the text by 15 December, with Parliament’s lead negotiator proposing an even longer delay that may be adjusted to match the Council’s stance.

WHAT ARE COMPANIES DOING?

Corporate sustainability, new tools and services & companies in the news

🛩️ DHL signed a three-year deal with Phillips 66 to purchase over 240,000 metric tons of SAF, one of the largest US SAF agreements to date. The supply, sourced from Phillips 66’s newly converted Rodeo Renewable Energy Complex, is expected to cut around 737,000 tons of lifecycle emissions and will primarily serve LAX, with deliveries expanding to other West Coast airports.

🛩️ FedEx also expanded its SAF use in the US, signing new agreements to source SAF for flights out of Chicago-O’Hare and Miami International Airport. FedEx will receive 1 million gallons of SAF blend in Chicago from Air bp and about 3 million gallons in Miami from AEG, following its first major US SAF purchase earlier this year in Los Angeles.

⚡️ Google launched a new Energy Assessment tool to help manufacturing companies identify energy-efficiency opportunities. The platform analyzes 20+ improvement options across systems like compressors, boilers, chillers, and lighting, offering tailored cost- and carbon-saving project recommendations.

EVERYTHING FINANCE

Sustainable finance, funding rounds, acquisitions & private equity deals

🇺🇸 Florida Attorney General James Uthmeier filed a lawsuit against proxy advisors Glass Lewis and ISS, accusing them of violating consumer protection and antitrust laws by “jointly promoting an ESG agenda” through their voting recommendations. The suit alleges the firms misled consumers, abused their dominance in a market they control up to 97%, and used their influence to push political positions on issues such as climate, diversity, and governance. It also claims the two companies act “in lockstep” to stifle competition. Glass Lewis rejected the allegations, calling them untrue and saying its institutional clients make their own voting decisions.

🏦 Crédit Agricole announced new sustainable finance goals, including a 90/10 green-brown ratio by 2028, meaning every €1 of fossil-fuel financing will be matched with €9 for low-carbon energy. The bank reaffirmed its existing 2030 sector decarbonization targets and committed to facilitating €240 billion in transition financing and generating €1 billion in sustainable finance revenues by 2028.

📈 The EIB and Societe Generale will jointly finance fast-growing cleantech SMEs and mid-caps, supported by €250 million in EIB guarantees to unlock affordable working-capital financing. The partnership targets companies advancing decarbonization, circular economy, bioeconomy, resource protection, and pollution control, addressing the funding challenges faced by early-stage cleantech firms with long development cycles.

📈 The IFC will invest $100 million in Brookfield’s Catalytic Transition Fund (CTF), supporting large-scale clean energy and transition projects in underserved emerging markets. CTF targets regions across Asia, Latin America, the Middle East, and Eastern Europe, backing business decarbonization, clean power technologies, and sustainable solutions such as energy efficiency and advanced waste systems.

Startup funding rounds

⚡️ X-energy raised $700 million in a Series D round as it prepares to deploy its advanced small modular reactors (SMRs). X-energy develops high-temperature gas-cooled reactors powered by TRISO-X fuel, which is designed to be meltdown-proof and operate safely at extreme temperatures. The company has an 11 GW orderbook covering roughly 144 reactors.

⚡️ HoloSolis raised over €220 million to build one of Europe’s largest solar panel factories in Sarreguemines-Hambach, France, aiming for 5 GW annual capacity by 2030, enough to power one million homes. The project will create around 2,000 jobs and supports efforts to strengthen Europe’s solar manufacturing sector as expansion slows.

🟢 Sortera raised $45 million to expand its AI-driven aluminum recycling. Sortera uses sensors and AI to sort high-value aluminum alloys from mixed scrap, processing 100 million pounds a year.

Did you like today's newsletter? |

PARTNER WITH US

Increase your brand awareness and visibility by reaching the right audience and target market. Showcase your company, solutions, services, products, reports, surveys, events, or other content in front of our highly targeted audience of +5,500 Sustainability & ESG professionals. Contact us at [email protected] if you think we can partner in some way.