- Green Digest

- Posts

- What's Happening in Sustainability & ESG (Week Recap 15.07 - 21.07) 🌎

What's Happening in Sustainability & ESG (Week Recap 15.07 - 21.07) 🌎

Most US companies still see sustainability as a competitive advantage

Today’s newsletter is brought to you by

This week’s read time: 8 minutes

Welcome to this edition of Green Digest, where you will get updated about everything happening in the Sustainability & ESG space in less than 10 minutes. 🌎

We go through tons of articles and data from the most reliable sources, filter & simplify them, and serve them to you in bite-sized chunks every week. 🍀

In this edition, we’ll cover:

• Most US companies still see sustainability as a competitive advantage, new EcoVadis survey reveals 🇺🇸

• EU Ombudsman has asked the EU Commission to explain its failure to follow key procedures in launching the “Omnibus” initiative 🇪🇺

• The UK government decided to scrap its plans for a UK Green Taxonomy 🇬🇧

• The UK will add GHG removals to its Emissions Trading Scheme by 2029 to support net zero and offset tough emissions 🇬🇧

• Apple, Google, and Microsoft sign major deals on recycling, clean energy, and carbon removal 🟢

• and other news 🌍

PRESENTED BY REUTERS EVENTS

Reuters Events Sustainability Europe 2025 (London, 21-22 October)

Join your peers at Reuters Events Sustainability Europe 2025 (London, 21-22 October) for an unparalleled exploration of sustainability. Through our unparallelled interactive formats you can engage with experts on CSRD, climate risk management, and ESG materiality, delve into sustainability reporting and due diligence strategies and navigate non-financial regulations to transform your business into a resilient, sustainable enterprise. With over 500 senior sustainability professionals, this event is your chance to lead on sustainable action and enhance your organisation’s future competitiveness. Join us on for insights and opportunities that will shape the European sustainability landscape, drive sustainable action and deliver corporate value.

THIS WEEK’S TOP NEWS

Regulatory Oversight & Industry Insights

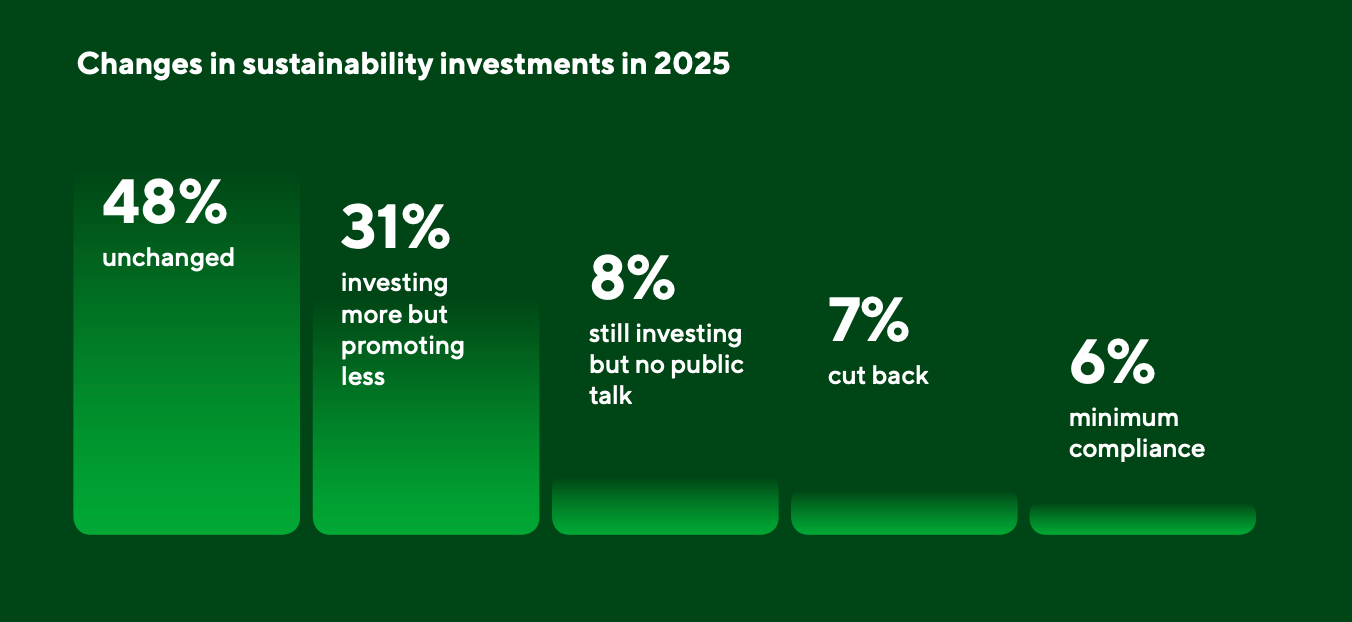

🇺🇸 The ‘2025 US Business Sustainability Landscape Outlook’ by EcoVadis reveals that despite growing political and regulatory uncertainty, a vast majority of US companies continue to treat sustainability as a strategic driver of competitiveness and resilience. Based on a survey of 400 business and operations leaders, the report finds that while 87% of companies have maintained or increased their sustainability investments, a significant portion are doing so more quietly, opting to reduce public promotion amid increasing political polarization and backlash, a trend known as “greenhushing.”

Most large US companies are maintaining or increasing sustainability investments | Source: EcoVadis

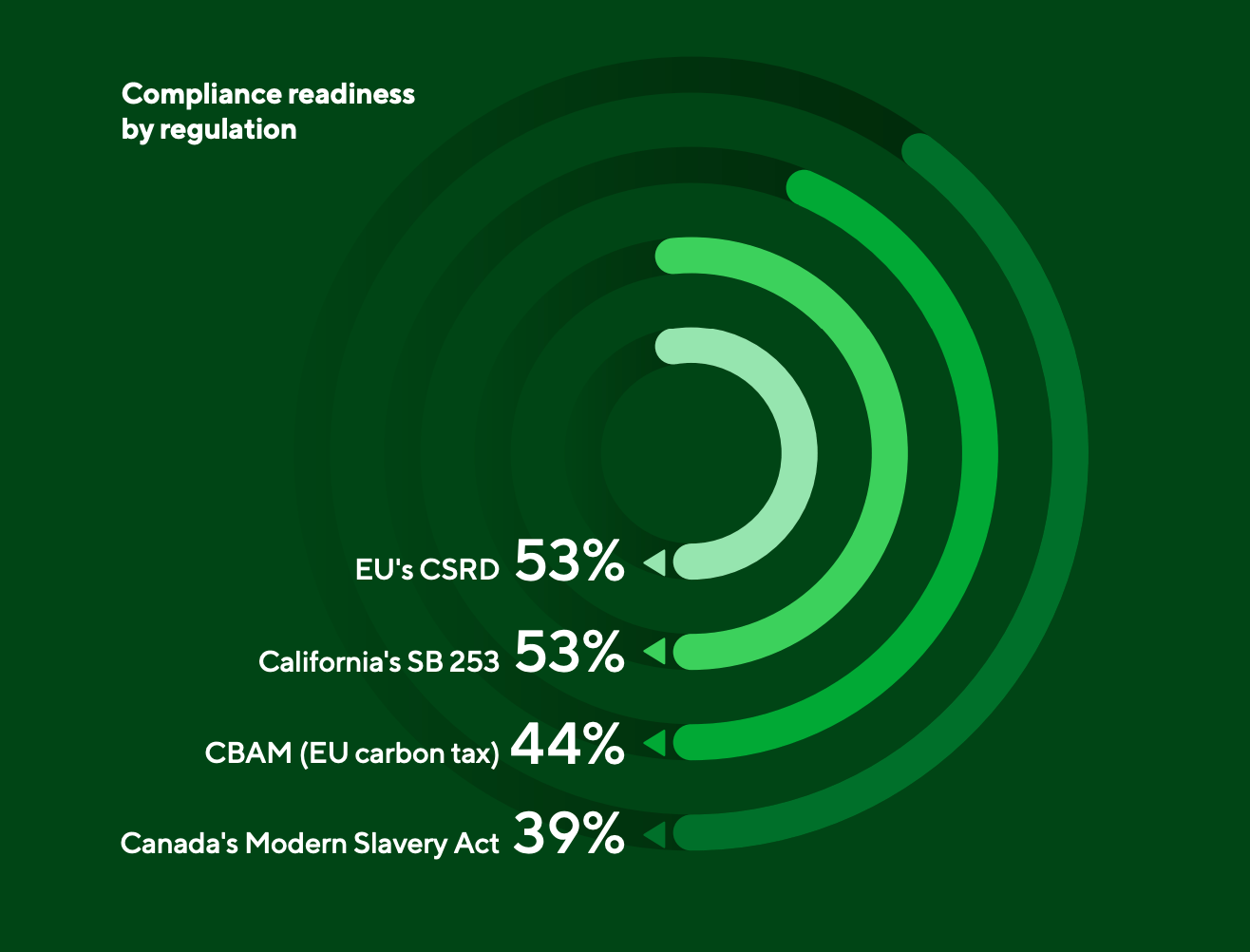

The report underscores that corporate leaders widely view sustainability as essential to managing supply chain risk, avoiding disruptions, and meeting global customer expectations. Nearly two-thirds believe sustainability provides a competitive edge through resilience and operational benefits, while finance leaders note its direct contribution to long-term growth. However, compliance gaps persist: many companies are struggling to meet the requirements of major regulations like the EU’s CSRD and CBAM or California’s SB 253, with some firms even resorting to estimated or inaccurate ESG data to satisfy expectations.

Less than 55% of companies are ready for key regulations like CSRD or SB 253 | Credit: EcoVadis

To address compliance and data reliability challenges, businesses are increasingly investing in ESG risk mapping, supplier engagement platforms, and other digital tools. While 33% of leaders still view ESG rollbacks as an opportunity for reduced bureaucracy and increased innovation, the majority warn that deregulation could severely impact transparency, inflate costs, and increase supply chain instability. Ultimately, the report advocates for proactive investment in scalable, tech-driven sustainability practices that build resilience, not just compliance.

📑 In related news - there’s been a sharp drop in sustainability report filings by large US companies in early 2025, but rather than a retreat, this is widely seen as a strategic pause. According to a Conference Board analysis cited by Trellis, only 432 reports were filed in the first half of 2025, compared to 831 during the same period last year. Major companies including Adobe, Citigroup, General Motors, and Uber are among those that have delayed publication. The slowdown reflects efforts to reframe ESG communications amid heightened political scrutiny under the Trump administration and ongoing uncertainty around EU sustainability regulations. Experts expect most delayed reports to be published later this year, as companies navigate evolving risks and observe how peers are approaching sensitive issues like climate and DEI.

MORE INTERESTING NEWS

Latest developments, reports, insights, and trends

🇪🇺 EU Ombudsman Teresa Anjinho requested explanations from the European Commission over its failure to follow key procedural steps in launching the “Omnibus” initiative, which aims to reduce corporate sustainability reporting and due diligence requirements. In a letter to Commission President Ursula von der Leyen, Anjinho questioned the lack of an impact assessment, public consultation, and climate consistency analysis, steps typically required under the Commission’s Better Regulation Guidelines and the European Climate Law. The Ombudsman also raised concerns about the rushed internal review process and limited stakeholder input, mainly from industry groups. The Commission has until September 15 to respond, with no extension planned.

🇬🇧 The UK government will integrate GHG removals (GGRs) into its Emissions Trading Scheme (ETS) by 2029 to help companies offset hard-to-abate emissions and support net zero goals. The move, focused initially on engineered solutions like Direct Air Capture and BECCS, aims to scale the removals market alongside emission cuts. Only verified UK-based removals with 200-year storage durability will be eligible, and new GGR allowances will replace emissions allowances under a fixed cap. The ETS may evolve into a flexible system enabling businesses to choose between decarbonizing or offsetting residual emissions efficiently.

🟢 In related news, after years of decline, carbon credit prices are expected to rise as new regulatory and commercial forces drive up demand, especially for high-quality credits. Four key trends are reshaping the market: (1) Nation states like EU members are planning to use carbon credits to meet climate targets, potentially absorbing large credit volumes; (2) Compliance markets are spreading globally, with countries like Japan, Singapore, and Vietnam launching schemes that allow limited credit use; (3) Airlines under CORSIA will need to buy millions of credits annually to offset emissions above 2019 levels, with demand rising sharply through 2035; and (4) Tech giants facing rising emissions are turning to credits to meet ambitious goals—Microsoft, Meta, and Amazon are among the biggest buyers. In response, companies are securing long-term offtake agreements to lock in prices and ensure access, as supply tightens and prices climb.

📑 The Science Based Targets initiative (SBTi) released two resources to support companies in meeting the mandatory five-year review of validated science-based targets. With a surge in target submissions and early adopters reaching the five-year mark, the new Mandatory Five-Year Review Guidance outlines a step-by-step process and deadlines for reviewing and updating targets to align with the latest SBTi Criteria. Complementing this, the SBTi Commitment and Target Statuses introduces new status categories to be reflected on the Target Dashboard, providing clearer insights into companies’ progress. These changes take effect on December 18, 2025, and include flexible extension options in select cases.

📑 The Global Reporting Initiative (GRI) released an exposure draft of its new Textiles and Apparel Sector Standard, designed to help companies in the textile, apparel, footwear, and jewelry sectors report transparently on key sustainability impacts. The standard highlights 18 likely material topics, including climate change, labor rights, hazardous chemicals, and supply chain traceability. It targets the sector’s complex supply chains and significant environmental and social risks, aiming to enhance accountability and embed responsible business practices. The draft is open for public consultation until September 28, 2025, with the final standard expected in Q2 2026.

WHAT ARE COMPANIES DOING?

Corporate sustainability, new tools and services & companies in the news

🧲 Apple announced a $500 million multi-year deal with MP Materials to secure domestically produced rare earth magnets and launch a new recycling line in California, supporting Apple’s goal to use 100% recycled rare earths in its devices by 2025. The partnership includes developing advanced magnet materials and processing technologies, while the new facility will convert recycled waste into high-performance components for Apple products.

⚡️ Google signed the world’s largest corporate clean power deal for hydropower, securing up to 3 gigawatts from Brookfield Asset Management to fuel its growing data center operations. The $3 billion, 20-year agreement covers two upgraded hydropower facilities in Pennsylvania and coincides with Google’s planned $25 billion investment in data centers across the region.

🟢 Microsoft signed a long-term offtake agreement with Vaulted Deep for up to 4.9 million tonnes of durable carbon removal over 12 years. Vaulted Deep uses proprietary slurry injection technology to sequester hard-to-manage organic waste—like biosolids and food sludge—deep underground for permanent storage with 10,000+ year durability. This brings Microsoft’s total carbon removal purchases to over 30 million tonnes, far ahead of other buyers.

⚡️ bp agreed to sell its onshore wind business, bp Wind Energy, to LS Power as part of its strategy to refocus on oil and gas and reduce investment in low-carbon energy. The sale includes 10 wind assets across the US with a net capacity of 1.3 GW and follows bp’s February 2025 plan to limit low-carbon spending to under 5% of capex and pursue $20 billion in divestments by 2027. bp stated it is no longer the best owner to advance the wind business despite its strong assets and team.

🚙 Stellantis announced it will discontinue its hydrogen fuel cell technology program, citing limited market progress, infrastructure challenges, and high costs as key reasons. The decision halts plans to launch hydrogen-powered vehicles and ends the company’s planned expansion under its Dare Forward 2030 strategy, which included large-scale production of hydrogen vans and a major stake in fuel cell firm Symbio. Stellantis stated it no longer expects significant adoption of hydrogen-powered light commercial vehicles before 2030 and will instead focus on its electric and hybrid vehicle lineup to meet regulatory and customer demands.

🟢 1PointFive, the CCUS-focused subsidiary of Occidental, signed a five-year agreement with Palo Alto Networks for 10,000 tons of carbon removal credits generated via direct air capture (DAC) at its upcoming STRATOS facility in Texas. The captured CO₂ will be permanently stored through saline sequestration, showcasing the growing demand for durable carbon removal. STRATOS is set to become the world’s largest DAC facility, with a capacity of 500,000 tons annually.

📊 Schneider Electric launched Zeigo Hub, a new digital platform designed to help companies decarbonize their supply chains by engaging suppliers, setting targets, and tracking emissions progress. Key features include guided supplier onboarding, emissions calculation tools, real-time analytics, and alignment with frameworks like CDP, CSRD, and TCFD. Suppliers receive tailored decarbonization roadmaps at no cost, funded by the sponsoring company.

📊 Datamaran launched the Datamaran Suite, a new ESG platform designed to help companies manage their sustainability strategies through advanced benchmarking, disclosure analysis, and target setting. Suite enhances AI-powered materiality assessments with new governance features and modules like IROs Benchmarking, which lets users compare their impact, risk, and opportunity disclosures against industry peers.

EVERYTHING FINANCE

Sustainable finance, funding rounds, acquisitions & private equity deals

🇬🇧 The UK government decided to scrap its plans for a UK Green Taxonomy, citing limited support from stakeholders and a preference to prioritize other sustainable finance policies. Launched in 2020 as part of efforts to classify environmentally sustainable activities, the taxonomy received only 45% positive sentiment in a recent consultation, with many respondents doubting its real-world effectiveness and suggesting that objectives like reducing greenwashing and directing investment could be better achieved through transition plans, the UK Sustainability Reporting Standards, and sector roadmaps.

🇪🇺 EU banks have made significant progress in managing climate and nature-related risks, with the share of banks meeting ECB expectations rising sharply since 2022, though gaps remain in applying these practices comprehensively, according to ECB Executive Board Member Frank Elderson. By the end of 2024, 56% of banks had advanced environmental risk practices in some areas (up from 3% in 2022), and only 5% lacked such practices entirely (down from 25%). Climate risk is now included in all banks’ stress testing, and over 90% recognize material exposure to environmental risks. However, the ECB noted shortcomings, including inconsistent application across risk types and geographies, underestimation of risk in stress testing, and limited coverage in capital assessments, especially in areas like mortgage lending and operational risk.

📑 Morningstar Sustainalytics raised the European Investment Bank’s (EIB) ESG risk score for the second time this year, citing increased exposure to human rights and geopolitical risks due to its expanded role in military funding. The EIB’s score rose from 5.0 to 5.2 after the EU authorized direct financing of military equipment makers, excluding arms and ammunition, and made defence a permanent policy goal with no funding cap. While still rated as having “negligible” risk and remaining in the top percentile of Sustainalytics’ 16,000-rated entities, the shift could draw greater stakeholder scrutiny.

Funding rounds:

⚡️ Sol Systems secured a $675 million revolving construction finance facility to support the development of solar and storage projects, starting with 500 MW across Illinois, Ohio, and Texas. Founded in 2008, Sol Systems operates a 7 GW clean energy portfolio across 38 US states.

🪨 GeologicAI raised $44 million in a Series B funding round to expand its AI-powered critical minerals discovery platform globally. The Canadian company uses advanced sensors and machine learning to analyze drill core samples in real time, improving exploration efficiency and lowering environmental impact.

⚡️ Amogy, a clean fuel tech startup specializing in ammonia-based zero-emission power systems, raised an additional $23 million, bringing its latest funding round to $80 million and total funding to nearly $300 million. Founded in 2020, the Brooklyn-based company targets hard-to-decarbonize sectors like maritime and heavy industry by converting liquid ammonia into hydrogen to power fuel cells or electric motors.

Did you like today's newsletter? |

PARTNER WITH US

Increase your brand awareness and visibility by reaching the right audience and target market. Showcase your company, solutions, services, products, reports, surveys, events, or other content in front of our highly targeted audience of +4,500 Sustainability & ESG professionals. Contact us at [email protected] if you think we can partner in some way.