- Green Digest

- Posts

- What's Happening in Sustainability & ESG (Week Recap 13.05 - 19.05) 🌎

What's Happening in Sustainability & ESG (Week Recap 13.05 - 19.05) 🌎

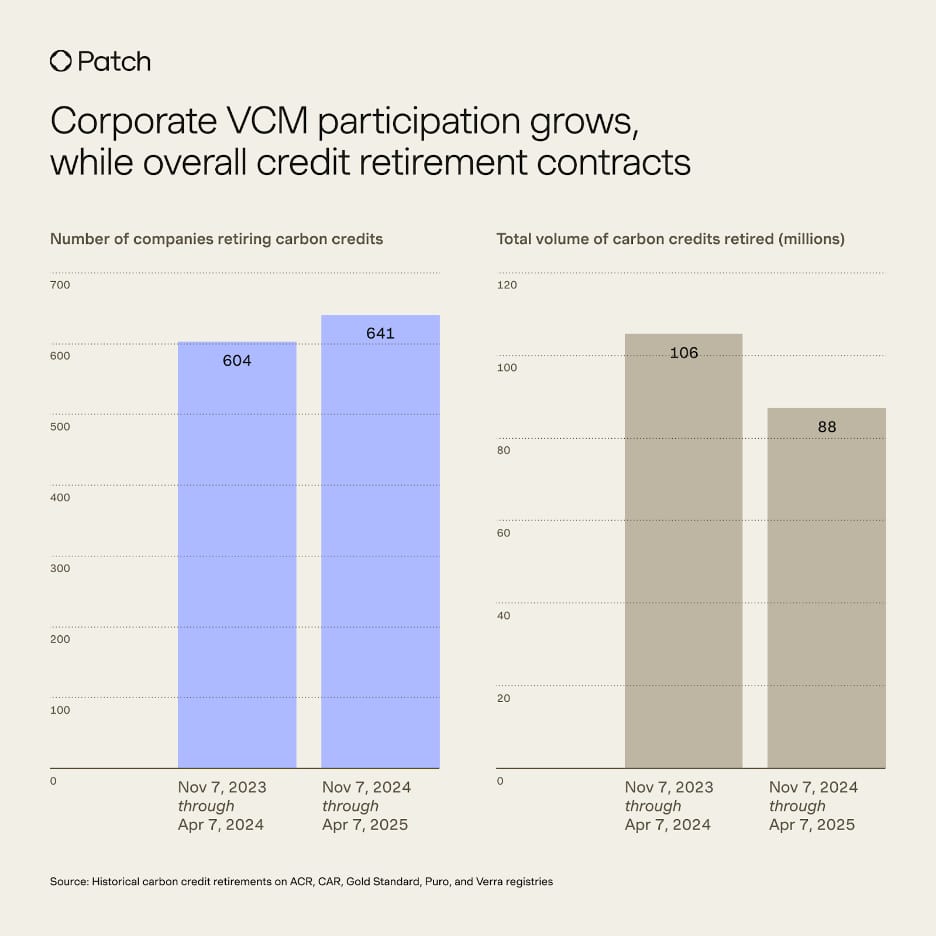

The number of companies retiring carbon credits rose post-US election, though the total volume declined

This week’s read time: 8 minutes

Welcome to this edition of Green Digest, where you will get updated about everything happening in the Sustainability & ESG space in less than 10 minutes. 🌎

We go through tons of articles and data from the most reliable sources, filter & simplify them, and serve them to you in bite-sized chunks every week. 🍀

Unlock exclusive benefits and support Green Digest by becoming a Pro Supporter!

As a Pro Supporter, you now have access to ad-free newsletters, a database of +250 resources, and exclusive discounts on GRI courses and The Sustainability Circle membership using our special code. Join us today and take advantage of these perks while helping us grow!

In this edition, we’ll cover:

• The number of unique companies retiring carbon credits rose by 6% post-US election, though the total volume of retired credits fell by 17% 🟢

• The ECON Committee proposes further cuts to CSRD and CSDDD scope, while new survey shows corporate support for existing sustainability frameworks 🇪🇺

• CDP to restructure amid score drop and reporting backlash 📑

• House Republicans proposed major cuts to the Inflation Reduction Act’s clean energy tax incentives 🇺🇸

• Environmental values and a strong sense of purpose are increasingly influencing the choices of Gen Z and Millennial workers and consumers 📑

• and other news 🌍

THIS WEEK’S TOP NEWS

Regulatory Oversight & Industry Insights

Source: Patch

🟢 The number of unique companies retiring carbon credits rose by 6% post-US election, though the total volume of retired credits fell by 17%, according to Patch’s 2025 The Hidden State The of the Voluntary Carbon Market report. This shift reflects a broader industry move from cheap offsetting to more impactful carbon contribution approaches, where fewer but higher-quality credits, like biochar and reforestation, are favored. Notably, 44% of buyers requested removals-only portfolios, and 79% sought BeZero-rated BBB or higher projects, revealing a clear preference for credible, science-aligned carbon removal over traditional avoidance credits.The market is also experiencing a supply crunch for premium credits, especially engineered and nature-based removals, as buyers increasingly pursue multi-year offtake agreements to secure long-term access. Biochar remains the most in-demand project, while reforestation and afforestation are highly sought after but under-supplied due to stringent quality and pricing criteria.

In related news, the UK and EU agreed to work towards linking their carbon markets, a move that pushed UK carbon prices up 6% and is expected to align UK prices more closely with higher EU levels. Both regions operate emissions trading systems that charge polluters per ton of CO2, and the linkage aims to reduce trade frictions, improve liquidity, and avoid double carbon taxation under the upcoming Carbon Border Adjustment Mechanism (CBAM). Analysts say alignment by 2027, when the UK launches its own CBAM, is ambitious but possible. A report estimates the link could deliver over €1.25 billion in economic benefits by 2030.

🇪🇺 The European Parliament’s ECON Committee is considering amendments that would drastically reduce the number of companies subject to the EU’s sustainability reporting and due diligence rules, going even further than the European Commission’s Omnibus proposal. The committee suggests raising the compliance threshold for both the CSRD and CSDDD to companies with over 3,000 employees and €450 million in revenue, downscaling coverage beyond the Commission’s already dramatic cut. It also proposes capping mandatory ESRS data points at 100 and removing the CSDDD’s requirement for climate transition plans. The proposals illustrate deep divisions within Parliament over the future of EU sustainability regulation.

Meanwhile, a new survey of over 1,000 companies provides detailed insights into how businesses view the EU’s CSRD and proposed Omnibus revisions. The majority of respondents (84%) expressed support for the EU’s broader sustainability goals, and 61% said they are satisfied with the CSRD in its current form. Only 25% voiced support for the Omnibus proposal, with 70% reporting feelings of confusion, frustration, or disappointment about it. The concern that CSRD harms competitiveness was the least cited of six potential barriers. Most companies, including those with 500–1,000 employees, did not support raising the CSRD threshold to 1,000 employees, favoring a lower cut-off. The results offer a structured snapshot of business sentiment and indicate that many companies are willing to engage with sustainability policy development.

MORE INTERESTING NEWS

Latest developments, reports, insights, and trends

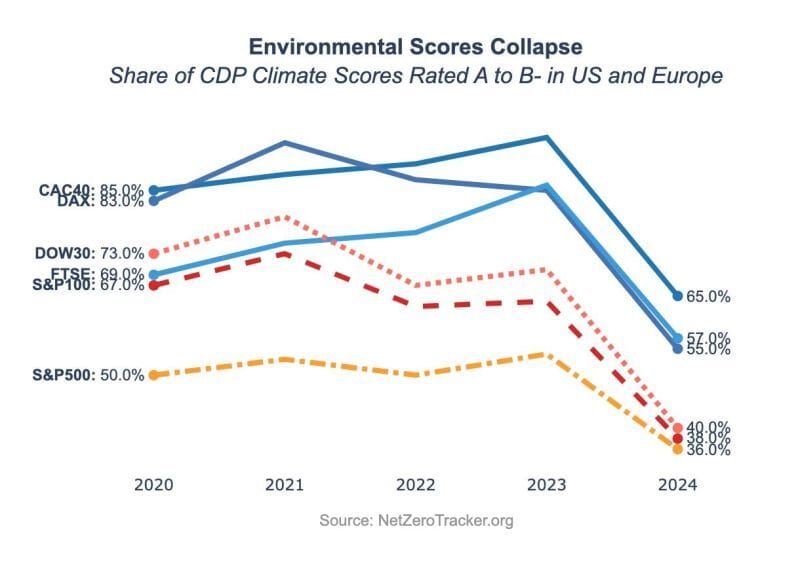

📑 Climate disclosure nonprofit CDP is undergoing a major strategic overhaul that includes cutting around 20% of its workforce, aiming to become a leaner, tech-enabled organization focused on reducing company reporting burdens and enhancing innovation. While CDP saw record engagement in 2024 with over 22,700 companies disclosing data, the year also marked a sharp drop in CDP scores, “driven not by political shifts, but by a significant, under-communicated methodology shift that increased reporting complexity”, according to Anastasia Kuskova, CEO of beSirius, and echoed by other sustainability professionals who worked with the updated questionnaires. Many companies struggled to meet new data demands, leading to incomplete submissions and frustration over rising costs with limited perceived value. The shakeup reflects mounting pressure on disclosure frameworks to justify their demands with tangible business benefits.

🇺🇸 House Republicans have proposed major cuts to the Inflation Reduction Act’s clean energy tax incentives, risking a sharp reversal of US climate progress and green investment momentum. The proposed rollback, part of broader budget negotiations, targets subsidies for clean electricity generation and domestic manufacturing, with analysts warning it could halt renewable deployment, derail $522 billion in planned investments, and increase electricity prices. While Senate Republicans remain divided, some fearing job losses in their districts, the outcome of these negotiations could shape America’s long-term competitiveness in a global clean tech market estimated to surpass $100 trillion by 2050. Experts warn that walking back IRA incentives without a viable alternative would hinder US efforts to catch up in mature tech like solar and EVs, and forfeit leadership in emerging sectors like hydrogen and advanced nuclear, leaving China to dominate.

📑 Environmental values and a strong sense of purpose are increasingly influencing the choices of Gen Z and Millennial workers and consumers, according to Deloitte’s 2025 survey of over 23,000 respondents worldwide. 70% consider a company’s environmental credentials when job hunting, nearly two-thirds are willing to pay more for sustainable products, and around 90% say purpose is key to job satisfaction. Rising eco-anxiety and firsthand experience with extreme weather are driving action - 15% have switched jobs over environmental concerns, nearly half have pushed employers to do more, and many are making personal lifestyle changes to reduce their environmental impact.

WHAT ARE COMPANIES DOING?

Corporate sustainability, new tools and services & companies in the news

🛢️ Climate non-profit Friends of the Earth Netherlands (Milieudefensie) is preparing to launch a new climate lawsuit against Shell, demanding a legal ban on new oil and gas exploration and court-imposed CO2 reduction targets. The group has formally notified Shell, citing the company’s legal duty of care and its continued investments in fossil fuel expansion. This case would be the first to seek a total halt to future oil and gas extraction by a corporation. It follows a 2021 court ruling requiring Shell to cut emissions by 45% by 2030, a decision later overturned on appeal in 2024.

🌳 Microsoft partnered with Rubicon Carbon to purchase 18 million tonnes of high-quality carbon removal credits over 15–20 years. The deal will support global Afforestation, Reforestation, and Revegetation (ARR) projects, advancing Microsoft’s position as the world’s leading corporate buyer of carbon removals. Rubicon, backed by TPG, will handle project sourcing, due diligence, and ongoing monitoring using remote-sensing tech and Microsoft’s evaluation framework. The collaboration aims to catalyze capital for scalable, high-impact carbon projects and reflects Microsoft’s push to make long-term carbon removal central to climate finance.

🛩️ Air New Zealand released new 2030 emissions guidance, aiming to cut “well-to-wake” net GHG emissions by 20–25% from 2019 levels, a year after withdrawing from the SBTi and scrapping its original 2030 goal. The airline cited lack of progress in key decarbonization levers, like fleet renewal and sustainable aviation fuel (SAF) availability, as reasons for retiring its more ambitious 28.9% carbon intensity reduction target. The new guidance relies heavily on SAF, which made up just 0.4% of the airline’s fuel mix last year, with a goal to reach 10% by 2030. While maintaining its 2050 net zero commitment, the company acknowledged the continued challenges of decarbonizing aviation and promised to update its long-term transition plan later this year.

👕 US textile recycling company Circ will build the world’s first industrial-scale plant to recycle polycotton (cotton and polyester blends) in France, backed by the French government and EU, with operations set to begin in 2028. The $500 million plant in Saint-Avold will process 70,000 metric tons of textile waste annually and create 200 jobs. Using hydrothermal technology, Circ’s process recovers polyester and cotton from blended fabrics—one of fashion’s most challenging waste streams. The facility supports the EU’s push for a circular economy and climate goals, with partners including Inditex and Patagonia already incorporating Circ’s recycled materials. The project aims to serve as a model for global expansion amid growing pressure on the fashion industry to cut emissions and meet sustainability targets.

EVERYTHING FINANCE

Sustainable finance, funding rounds, acquisitions & private equity deals

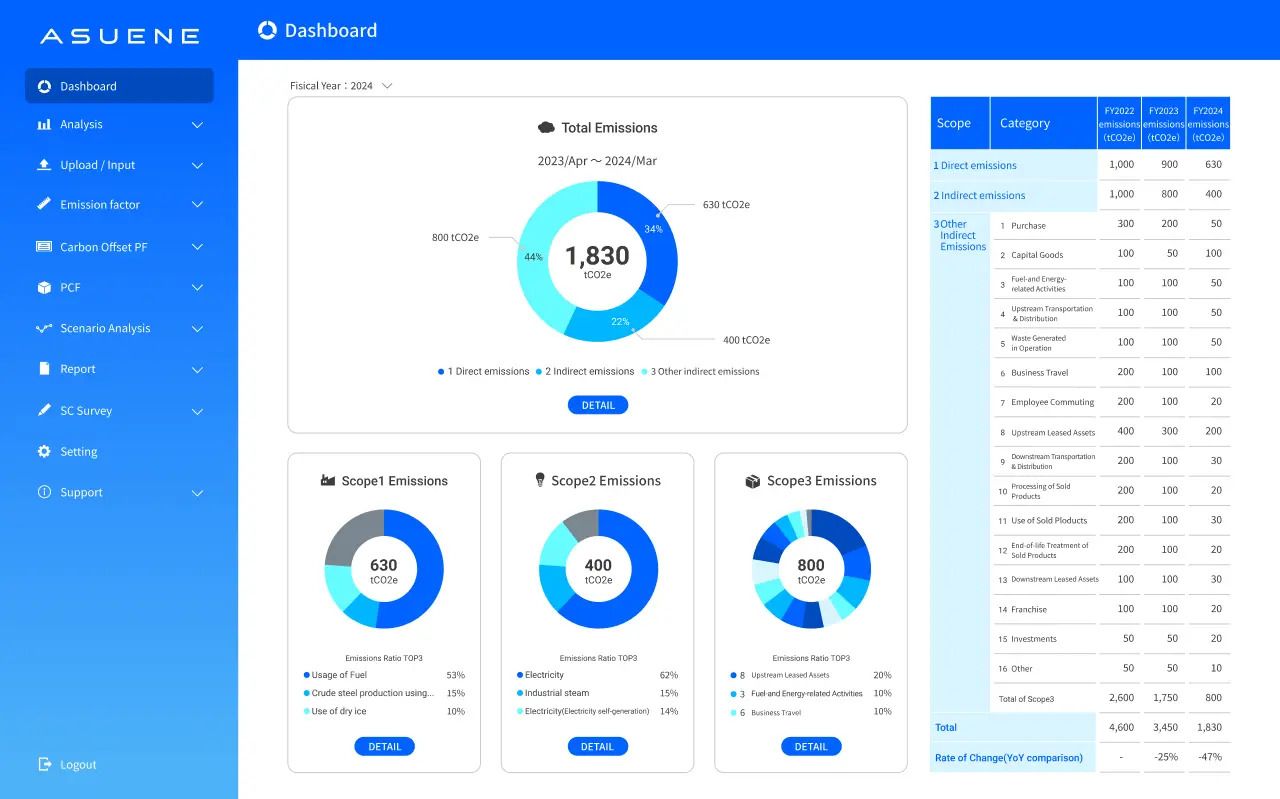

A screenshot of Asuene’s dashboard | Credit: Asuene

📊 Tokyo-based climate tech firm Asuene acquired US-based carbon accounting platform nZero, marking its entry into the North American greentech and corporate sustainability space. Asuene, which serves over 10,000 clients globally, helps businesses measure and reduce CO2 emissions, while nZero provides real-time carbon tracking across Scopes 1, 2, and 3 using AI-driven insights. The move enables Asuene to expand its footprint across US cities and sectors, positioning the combined company to offer data-driven, measurable decarbonization tools amid diverging national and local climate policies.

⚡️ ENGIE North America announced a major investment from CBRE Investment Management in a 2.4 GW portfolio of battery storage assets across Texas and California - one of the largest battery storage financing deals to date. The portfolio includes 31 operational projects in the ERCOT and CAISO regions, supporting grid resilience amid rising energy demand from sectors like transport electrification and AI computing. The partnership aligns with ENGIE’s capital recycling strategy and clean energy goals, while enabling CBRE IM to expand its infrastructure portfolio with assets backed by strong revenue and decarbonization trends.

⚡️ Octopus Energy Group launched the CG Octopus Energy Sustainable Growth Fund I (Astris), a new $220 million fund designed to give pension schemes and private wealth investors access to more than 50 renewable energy projects—including wind, solar, and battery storage—across 15 countries. The fund is among the first to receive the UK FCA’s new “Sustainability Focus” label under the SDR framework and offers monthly liquidity, enabling broader access to private markets. Octopus aims to remove traditional investment barriers and position the fund as a gateway to the $275 trillion energy transition opportunity.

⚡️ Blackstone Infrastructure signed deal to acquire electric utility holding company TXNM Energy in an $11.5 billion deal to support clean energy transition and growth in Texas and New Mexico. TXNM, which serves over 800,000 customers through its utilities PNM and TNMP, is advancing New Mexico’s carbon-free energy goals and investing to meet rapid demand in Texas. The deal includes a $400 million equity investment by Blackstone, and TXNM will remain locally managed and regulated. The acquisition, unanimously approved by TXNM’s board, is expected to close in the second half of 2026.

Funding rounds:

🟢 Enhanced rock weathering (ERW) startup Mati Carbon announced a new blended finance facility from JP Morgan to scale its carbon removal operations globally. Founded in 2022, Mati uses crushed basalt on farmland to accelerate CO₂ drawdown while improving soil health and farmer livelihoods.

📡 OroraTech extended its Series B funding round to €37 million, raising an additional €12 million to scale its satellite-powered wildfire forecasting technology. The Munich-based company, which has launched ten satellites, uses high-resolution thermal data and AI to deliver real-time wildfire detection and simulation through its Wildfire Solution platform.

⚡️ Fusion energy startup Realta Fusion secured $36 million in a Series A round to advance its compact magnetic mirror fusion system toward commercialization. Founded in 2022, the Wisconsin-based company is developing a modular fusion device designed to deliver on-site, carbon-free heat and electricity for heavy industries like data centers and chemical plants.

📊 Sustainability reporting software provider Novisto raised $27 million in a Series C round to enhance its ESG platform and expand across Europe, citing a major market opportunity amid evolving regulations. Founded in 2019, the Montreal-based firm enables global enterprises to manage ESG data and streamline sustainability reporting.

Did you like today's newsletter? |

Learn AI in 5 minutes a day

What’s the secret to staying ahead of the curve in the world of AI? Information. Luckily, you can join 1,000,000+ early adopters reading The Rundown AI — the free newsletter that makes you smarter on AI with just a 5-minute read per day.

PARTNER WITH US

Increase your brand awareness and visibility by reaching the right audience and target market. Showcase your company, solutions, services, products, reports, surveys, events, or other content in front of our highly targeted audience of +4,250 Sustainability & ESG professionals. Contact us at [email protected] if you think we can partner in some way.