- Green Digest

- Posts

- What's Happening in Sustainability & ESG (Week Recap 08.07 - 14.07) 🌎

What's Happening in Sustainability & ESG (Week Recap 08.07 - 14.07) 🌎

Will the “CSRD glass” really be empty after the Omnibus?

Today’s newsletter is brought to you by

This week’s read time: 8 minutes

Welcome to this edition of Green Digest, where you will get updated about everything happening in the Sustainability & ESG space in less than 10 minutes. 🌎

We go through tons of articles and data from the most reliable sources, filter & simplify them, and serve them to you in bite-sized chunks every week. 🍀

In this edition, we’ll cover:

• Latest from the EU: The Commission adopts “quick fix” amendments to the ESRS, EFRAG proposes a 66% cut in datapoints, and the Parliament rejects the EUDR’s country benchmarking system 🇪🇺

• Since being removed by SBTi for missing target deadlines, only 17 of the 239 companies delisted—including Unilever, Microsoft, and JBS—have had their net-zero targets revalidated 📑

• The California Air Resources Board (CARB) released a new FAQ to guide companies in complying with the two major climate disclosure laws 🇺🇸

• European climate tech funding plunged 71% in the first half of 2025, with total investment dropping from €21.7bn to €6.2bn 📉

• HSBC has withdrawn from the UN-backed Net-Zero Banking Alliance, becoming the first major UK bank to exit the coalition 🏦

• and other news 🌍

PRESENTED BY REUTERS EVENTS

Reuters Events Sustainability Europe 2025 (London, 21-22 October)

Join your peers at Reuters Events Sustainability Europe 2025 (London, 21-22 October) for an unparalleled exploration of sustainability. Through our unparallelled interactive formats you can engage with experts on CSRD, climate risk management, and ESG materiality, delve into sustainability reporting and due diligence strategies and navigate non-financial regulations to transform your business into a resilient, sustainable enterprise. With over 500 senior sustainability professionals, this event is your chance to lead on sustainable action and enhance your organisation’s future competitiveness. Join us on for insights and opportunities that will shape the European sustainability landscape, drive sustainable action and deliver corporate value.

THIS WEEK’S TOP NEWS

Regulatory Oversight & Industry Insights

🇪🇺 The European Commission adopted “quick fix” amendments to the first set of ESRS to ease reporting burdens for “Wave One” companies reporting on financial year 2024. The amendments extend existing reporting relief to 2025 and 2026, allowing companies to continue omitting certain disclosures—such as the financial effects of sustainability risks—and granting larger firms access to phase-in provisions previously limited to smaller ones. These fixes address a gap left by the “Stop-the-clock” Directive, which postponed reporting for Wave Two and Three companies. A broader ESRS revision, aiming to reduce data requirements and improve clarity, is underway and expected by 2027. EFRAG also proposed major changes to the EU’s ESRS, including cutting required data points by around 66% and eliminating all voluntary disclosures or “may” datapoints.

In related EU news, the European Parliament voted to reject a key benchmarking system within the EU Deforestation Regulation (EUDR), raising concerns of further delays to the law’s implementation. The rejected benchmarking system classified countries by deforestation risk to adjust due diligence obligations accordingly, but lawmakers argued it relied on outdated data and failed to reflect real-world conditions. The European People’s Party (EPP), which led the objection, called for the addition of a “no risk” category for countries with stable or growing forests.

🔍 Will the “CSRD glass” really be empty after Omnibus?

Credit: Maximilian Müller

Shared in a recent LinkedIn post by Maximilian Müller, Professor at the University of Cologne.

The Omnibus I proposal might reduce the number of firms in scope of the CSRD by ~80% and (ii) cut ESRS datapoints by over ~50%. That could leave us with just 10% of the originally expected data.

To illustrate:

The CSRD was set to cover ~60,000 firms, each reporting ~500 datapoints → ~30 million datapoints in total.

After Omnibus, we might see only ~12,000 firms reporting ~250 datapoints → ~3 million datapoints in total.

So while the glass may appear almost empty in terms of raw volume, the remaining 20% of firms still represent around 80% of large-company economic activity, and the remaining datapoints may be the most relevant and decision-useful.

MORE INTERESTING NEWS

Latest developments, reports, insights, and trends

📑 After the Science Based Targets initiative (SBTi) removed 239 companies (including Unilever, Microsoft, and JBS) in March 2024 for missing target submission deadlines, only 17 have since had net-zero targets revalidated, while the vast majority have not returned to the framework. Some, like Unilever and Microsoft, continue to pursue net-zero goals through other platforms such as The Climate Pledge or the ACT Initiative, which offer greater flexibility around offsets or interim targets. Companies cite differences in definitions, timing, and reporting requirements as reasons for the divergence. Still, SBTi has seen record growth in submissions over the past two years, and many companies are watching closely as it updates its net-zero standard. For now, the gap raises concerns about fragmentation in corporate climate action and whether voluntary frameworks can deliver the consistency needed for meaningful progress.

🇺🇸 The California Air Resources Board (CARB) released a new FAQ to guide companies in complying with two major climate disclosure laws—SB 253 and SB 261—set to take effect in 2026. SB 253 requires companies with over $1 billion in revenue doing business in California to report their Scope 1, 2, and 3 emissions, while SB 261 mandates firms with over $500 million in revenue to disclose climate-related financial risks and mitigation measures. Scope 1 and 2 reporting begins in 2026, Scope 3 in 2027, and limited third-party assurance will be required starting in 2026, with reasonable assurance by 2030. Climate risk reports must be submitted by January 1, 2026, and biennially thereafter.

📉 European climate tech funding plunged 71% in the first half of 2025, with total investment dropping from €21.7bn to €6.2bn, largely due to a sharp decline in late-stage debt deals. Debt financing fell from €14bn to just €748m, driven by the absence of mega-rounds like those seen in 2024 for firms such as Northvolt and Stegra. Investors cite a “hangover” from last year’s big deals, shifting focus to sectors like robotics and manufacturing, and a temporary pause as funded projects move into the build phase. Still, high-quality climate startups—particularly in areas like energy-efficient chip design and B2B energy procurement—are raising strong equity rounds, signaling a market shift away from capital-intensive ventures toward leaner, more revenue-generating businesses.

WHAT ARE COMPANIES DOING?

Corporate sustainability, new tools and services & companies in the news

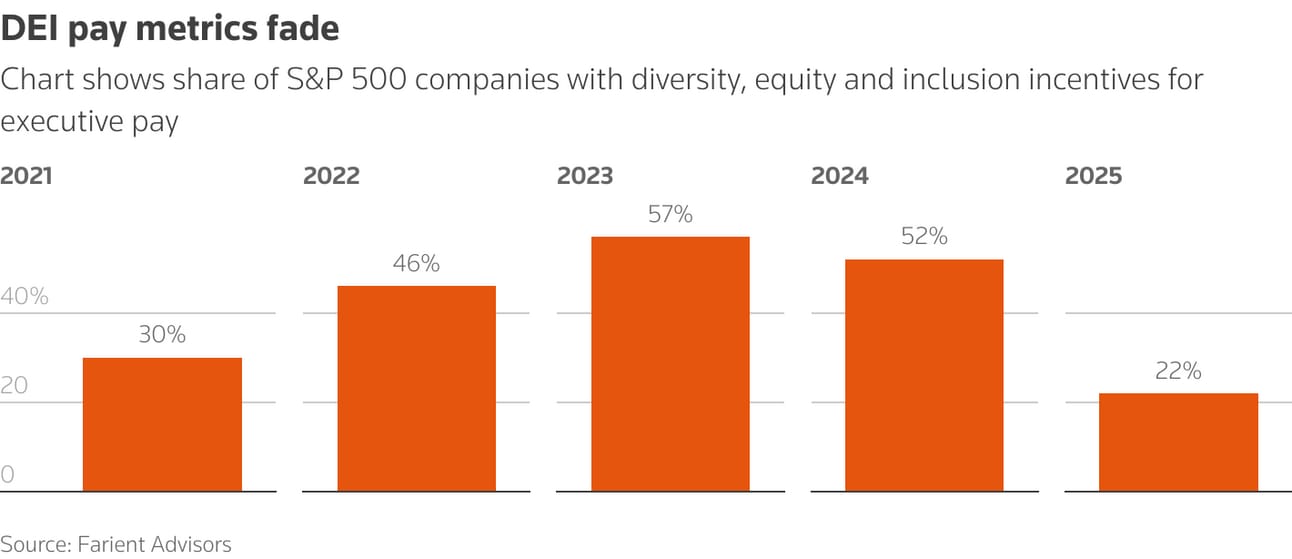

Source: Farient Advisors | Credit: Reuters

⏪ The use of diversity, equity, and inclusion (DEI) metrics in executive compensation plans at S&P 500 companies has sharply declined amid political pressure and legal concerns. A review by Farient Advisors shows that only 22% of companies now include DEI measures in pay packages, down from 52% last year and 57% in 2023. This retreat follows criticism from conservative activists and growing scrutiny under the Trump administration. Companies like Textron, Verizon, and Mastercard have removed or reworded DEI-related goals, with some citing legal risk or progress in related areas. While some firms still support DEI in principle, critics argue that many are simply rebranding efforts to avoid backlash.

🛩️ Shell, Accenture, and Amex GBT announced major updates to Avelia, their blockchain-based sustainable aviation fuel (SAF) book-and-claim platform, transitioning it into a multi-supplier industry solution to help scale SAF adoption. Originally launched in 2022 with Shell as the sole SAF provider, Avelia has now facilitated over 33 million gallons (124 million liters) of SAF at 17 global airports, enabling more than 300,000 tonnes of CO₂e abatement. The platform will now allow participation from multiple SAF suppliers and is exploring a “Bring Your Own SAF” model to integrate third-party SAF purchases.

🟢 Carbon removal buyer coalition Frontier signed a $41 million offtake agreement with Arbor to remove 116,000 tons of CO₂ between 2028 and 2030 on behalf of buyers like Google, Shopify, and H&M Group. The deal will support Arbor’s first commercial plant in Louisiana and scale its new high-efficiency process, which uses advanced oxy-combustion and rocket-inspired turbomachinery to convert biomass into clean electricity while capturing over 99% of CO₂. Arbor’s approach produces 1,000 kWh of electricity per ton of CO₂ removed and may also supply excess water for data centers and agriculture.

🟢 Microsoft signed a new long-term agreement to purchase nearly 3 million tons of carbon removal credits from the Gaia project—a joint venture between Copenhagen Infrastructure Partners and Vestforbrænding—which will retrofit a Danish waste-to-energy plant with large-scale carbon capture technology. Starting in 2029, the facility is expected to capture 500,000 tons of CO₂ annually, with biogenic CO₂ removals qualifying as carbon credits.

⚡️ Google cut data center emissions by 12% in 2024 despite a 27% increase in electricity demand, thanks to adding 2.5 GW of clean energy from 25 new projects. However, its total carbon footprint still rose, with Scope 3 emissions—mainly from its supply chain—increasing by 22%, driven by fossil-heavy manufacturing regions. In its 2025 Environmental Report, Google reaffirmed its 2030 climate goals but acknowledged rising challenges, including surging AI-driven energy demand, uneven regional decarbonization, and slow CFE deployment.

📊 Microsoft and ESG data platform Novata have partnered to deliver AI-powered sustainability solutions to small and medium-sized enterprises (SMEs), including Microsoft suppliers. The collaboration will focus on co-developing tools to simplify ESG data collection and climate reporting, using Microsoft Azure AI Foundry and Fabric. Microsoft will act as a key sales partner for Novata’s platform, expanding access to SMEs, while Novata will support Microsoft’s supply chain reporting efforts.

⚡️ Iberdrola and Masdar announced a €5.2 billion co-investment in the 1.4 GW East Anglia THREE offshore wind project, the largest offshore wind deal of the decade. The UK-based project, expected to power 1.3 million homes by late 2026, will be jointly owned and governed by the two firms and benefits from government CfDs and a PPA with Amazon.

⚡️ Japan’s Sumitomo Corporation signed a partnership with the UK government to drive £7.5 billion ($10.2 billion) in clean energy and infrastructure investment by 2035. The deal will focus on offshore wind and hydrogen projects, supporting the UK’s ambition to become a global clean energy leader.

EVERYTHING FINANCE

Sustainable finance, funding rounds, acquisitions & private equity deals

🏦 HSBC has withdrawn from the UN-backed Net-Zero Banking Alliance (NZBA), becoming the first major UK bank to exit the coalition amid rising political pressure and internal climate strategy shifts. While reaffirming its commitment to net zero by 2050, HSBC’s move follows a wave of similar exits by North American and global banks facing anti-ESG backlash, and comes alongside recent decisions to delay operational targets, review interim goals, and restructure its sustainability leadership.

📑 Support for shareholder proposals on environmental and social issues has dropped sharply in the US, falling to an average of 16% in the year ending June 2025—half the level seen in 2022, according to Morningstar. Major proxy advisors ISS and Glass Lewis also reduced support for ESG-related proposals, facing pressure from conservative groups. Improved corporate disclosures on emissions and diversity have further weakened the case for new resolutions, while investors remain cautious of political and reputational risks. Meanwhile, “anti-ESG” resolutions from conservatives continue to receive minimal support, averaging just 2.7%, though some are quietly settled to avoid public scrutiny.

📑 ISS Sustainability Solutions launched the Sovereign Climate Impact Report to help investors assess climate-related risks and impacts in sovereign portfolios. Part of its broader Climate Solutions suite, the new tool offers over 180 metrics covering carbon footprinting, transition analysis, scenario alignment, and climate policy. It enables compliance with key disclosure frameworks like ISSB, TCFD, CSRD, and SFDR, and includes scenario modeling aligned with IEA and NGFS net-zero pathways.

Funding rounds:

🟢 Tulum Energy raised $27 million in seed funding to commercialize an accidental discovery from 20 years ago that enables low-cost, zero-emission hydrogen production via methane pyrolysis. The company aims to produce hydrogen at $1.50/kg, significantly undercutting green hydrogen prices while monetizing both hydrogen and carbon outputs.

⚡️ Energy infrastructure startup Unblock raised $13.5 million to scale its modular data centers that convert wasted energy into computing power across Latin America. Founded in 2021, the company tackles flared gas and curtailed renewable energy at remote sites, claiming to offset 142,000 tons of CO₂ annually while creating value for energy producers.

🔌 Cariqa raised €4 million in seed funding to streamline Europe’s fragmented EV charging payments landscape. The platform addresses inconsistent and complex payment systems across thousands of charging points, which hinder EV adoption.

Did you like today's newsletter? |

PARTNER WITH US

Increase your brand awareness and visibility by reaching the right audience and target market. Showcase your company, solutions, services, products, reports, surveys, events, or other content in front of our highly targeted audience of +4,400 Sustainability & ESG professionals. Contact us at [email protected] if you think we can partner in some way.