- Green Digest

- Posts

- What's Happening in Sustainability & ESG (27.01 - 02.02) 🌎

What's Happening in Sustainability & ESG (27.01 - 02.02) 🌎

UK proposes new rules to expand sustainability reporting for listed companies

This week’s read time: 8 minutes

Welcome to this edition of Green Digest, where you will get updated about everything happening in the Sustainability & ESG space in less than 10 minutes. 🌎

We go through tons of articles and data from the most reliable sources, filter & simplify them, and serve them to you in bite-sized chunks every week. 🍀

In this edition, we’ll cover:

• The UK’s Financial Conduct Authority launched a consultation on new rules to expand sustainability reporting for listed companies 🇬🇧

• Leaked draft and new EU policy documents signal shift to link decarbonisation with “Made in EU” industrial strategy via public procurement 🇪🇺

• GHG Protocol launched its new Land Sector and Removals Standard 📑

• IPSASB released SRS 1, its first climate-related disclosure standard for governments and public sector entities 📑

• Norway’s $2tn sovereign wealth fund warned that extreme climate shocks and a correction in AI valuations pose major risks to its portfolio 🇳🇴

• and other news 🌍

PRESENTED BY UPRIGHT PROJECT

[Webinar] How to quantify sustainability risks in financial terms

🗓️ Tue, Feb 17 | 13:00–14:00 CET

Sustainability teams are under pressure to explain sustainability topics in P&L, balance sheet, and cash flow terms.

Why financial quantification is becoming unavoidable

How monetisation changes prioritisation and ERM

See a live demo of AI-enabled financial effects analysis.

Trusted by 300+ companies incl. Nasdaq, Orkla & Pictet.

Join live & get the recording HERE

THIS WEEK’S TOP NEWS

Regulatory Oversight & Industry Insights

🇬🇧 The UK’s Financial Conduct Authority launched a consultation on new rules to expand sustainability reporting for listed companies, proposing mandatory adoption of the forthcoming IFRS-based UK Sustainability Reporting Standards (UK SRS) from January 2027. The proposal would move companies beyond TCFD-aligned climate disclosures to broader sustainability reporting aligned with ISSB standards, aiming to improve consistency for investors and reduce duplication for international issuers.

The proposal is closely linked to the work of the IFRS Foundation and its International Sustainability Standards Board (ISSB), which released IFRS S1 (general sustainability) and IFRS S2 (climate) standards in 2023 after assuming responsibility for the Task Force on Climate-related Financial Disclosures (TCFD). The UK government issued exposure drafts of UK SRS S1 and S2 in June 2025 (which correspond to the ISSB’s S1 and S2 standards), with final standards expected in early 2026, forming the basis for the FCA’s proposed disclosure regime.

To reflect company readiness, the FCA proposes phased implementation and flexibility through transition reliefs and a “comply or explain” approach. Climate disclosures under UK SRS S2 would be mandatory, with a one-year exemption for Scope 3 emissions followed by comply-or-explain reporting, while broader sustainability disclosures under UK SRS S1 would benefit from a two-year transition before the same approach applies. The consultation is open until March 20, 2026, and final rules are targeted to take effect in January 2027.

In related news, the UK’s Competition and Markets Authority (CMA) issued new guidance stating that responsibility for misleading green claims is shared across the supply chain, meaning retailers, brands, and manufacturers can be liable even when passing on supplier information. The CMA said businesses must verify environmental claims, including indirect ones, and warned that if claims cannot be substantiated due to missing evidence, companies should change how they communicate them or reconsider supplier relationships, with tougher scrutiny for firms lacking internal verification processes under its Green Claims Code.

PRESENTED BY ECONOMIST IMPACT

Economist Impact’s 11th annual Sustainability Week | March 2nd - 4th 2026, London

Economist Impact’s 11th annual Sustainability Week brings together leaders to share case studies, insights, and ideas to drive action on sustainability. With more than 400 speakers, 2,500 in-person attendees, and 80 case studies, the 11th annual Sustainability Week tackles sustainability-related business challenges, finds solutions, and gets results. Meet the most influential industry leaders, policymakers, and innovators.

Learn more on the event website and register here. Green Digest readers can save 20% on registration using the discount code GD-SW20.

MORE INTERESTING NEWS

Latest developments, reports, insights, and trends

🇪🇺 A leaked draft of the EU’s upcoming Industrial Accelerator Act signals a shift toward linking decarbonisation with “Made in EU” industrial strategy, using public procurement to scale low-carbon products. The Act aims to create lead markets for materials like steel, cement, and aluminium by setting emissions and origin criteria in procurement, prioritising EU production where it supports strategic autonomy. It also proposes a harmonised low-carbon label based on existing frameworks to steer competition toward performance over cost, highlighting that despite simplification pushback, the EU continues to advance sustainability through industrial and geopolitical policy tools.

A new European Parliament briefing on the forthcoming Circular Economy Act (CEA) also signals that EU sustainability policy will increasingly blend industrial competitiveness, geopolitics, and green public procurement to scale circular solutions. The CEA is expected to mandate greater recovery of critical materials from waste streams, such as rare earths from e-waste, to reduce dependence on foreign supply, and to amend key waste and landfill directives alongside possible tax harmonisation. Overall, it points to a policy shift where circularity is positioned as both an environmental and strategic industrial priority, with the proposal expected in Q3 2026.

📑 GHG Protocol launched its new Land Sector and Removals (LSR) Standard, aimed at establishing the first global framework for companies to measure and report emissions and CO₂ removals from agriculture and land use. Effective from January 2027, the standard closes a gap in corporate carbon accounting by introducing consistent metrics for land-use change, agricultural practices, biogenic emissions, lifecycle impacts, and carbon removals, and aligns with major reporting frameworks such as ISSB and ESRS, with forest carbon accounting guidance to follow.

📑 The International Public Sector Accounting Standards Board (IPSASB) released SRS 1, its first climate-related disclosure standard for governments and public sector entities, marking a major step toward standardized public sector sustainability reporting. The new standard, developed with World Bank support, aligns closely with IFRS S2 and requires disclosures across governance, strategy, risk management, and metrics and targets, including Scopes 1, 2, and 3 emissions, while focusing on entities’ own operations rather than public policy outcomes.

🇺🇸 The US has formally exited the Paris Agreement, becoming the only country to withdraw from the global climate pact and marking President Trump’s second exit from the accord. The move follows a broader rollback of US climate policy, including plans to leave international climate bodies such as the UNFCC, while US states and other countries reaffirmed their commitment to the agreement’s goals despite the federal withdrawal.

PRESENTED BY SUSTAINABILITY MAGAZINE

Sustainability LIVE: The US Summit returns on 21-22 April, bringing together leaders who are driving real progress on sustainability across their organisations. With over 1,000 in-person attendees, the two-day event delivers the insights, connections, and practical takeaways needed to move from intention to impact. The agenda features 50+ speakers, 10 focused content themes, and four executive workshops designed to support action on climate, circularity, responsible growth, and culture change.

WHAT ARE COMPANIES DOING?

Corporate sustainability, new tools and services & companies in the news

🌳 A Trafigura-backed initiative to restore African Miombo woodlands has selected its first four carbon removal projects, targeting over 50 million metric tons of CO₂ removal and at least $1 billion in investment over 40 years. Covering 675,000 hectares across Malawi, Zambia, Tanzania, and Mozambique, the company said the projects will generate high-quality carbon credits, with 10–60% of revenues shared with farmers, communities and governments, while Trafigura supports financing and credit sales as part of the Miombo Restoration Alliance.

🟢 Holcim invested in Norway’s Capsol Technologies to strengthen its near-zero cement strategy and expand its portfolio of carbon capture solutions. Capsol’s post-combustion carbon capture technology uses hot potassium carbonate solvents to remove CO₂ from industrial gas streams, offering a scalable option for one of the hardest-to-abate sectors.

📊 ERM and Auquan partnered to deploy agentic AI across sustainability workflows for financial institutions, aiming to speed up and scale ESG and reputational risk analysis. ERM will use Auquan’s Sustainability Agent to scan global media, regulatory filings and stakeholder reports, helping investors meet stricter requirements such as SFDR Article 8 and strengthen sustainability due diligence across transactions.

🟢 Puro.earth launched Puro Issuance Plus, a new service designed to help scaled carbon removal suppliers bring verified CO₂ Removal Certificates to market faster and more frequently. The service enables batch-based issuance to shorten the time between carbon removal and credit availability, supporting quicker revenue generation for eligible industrial-scale suppliers that meet Puro.earth’s verification, quality, and data requirements.

EVERYTHING FINANCE

Sustainable finance, funding rounds, acquisitions & private equity deals

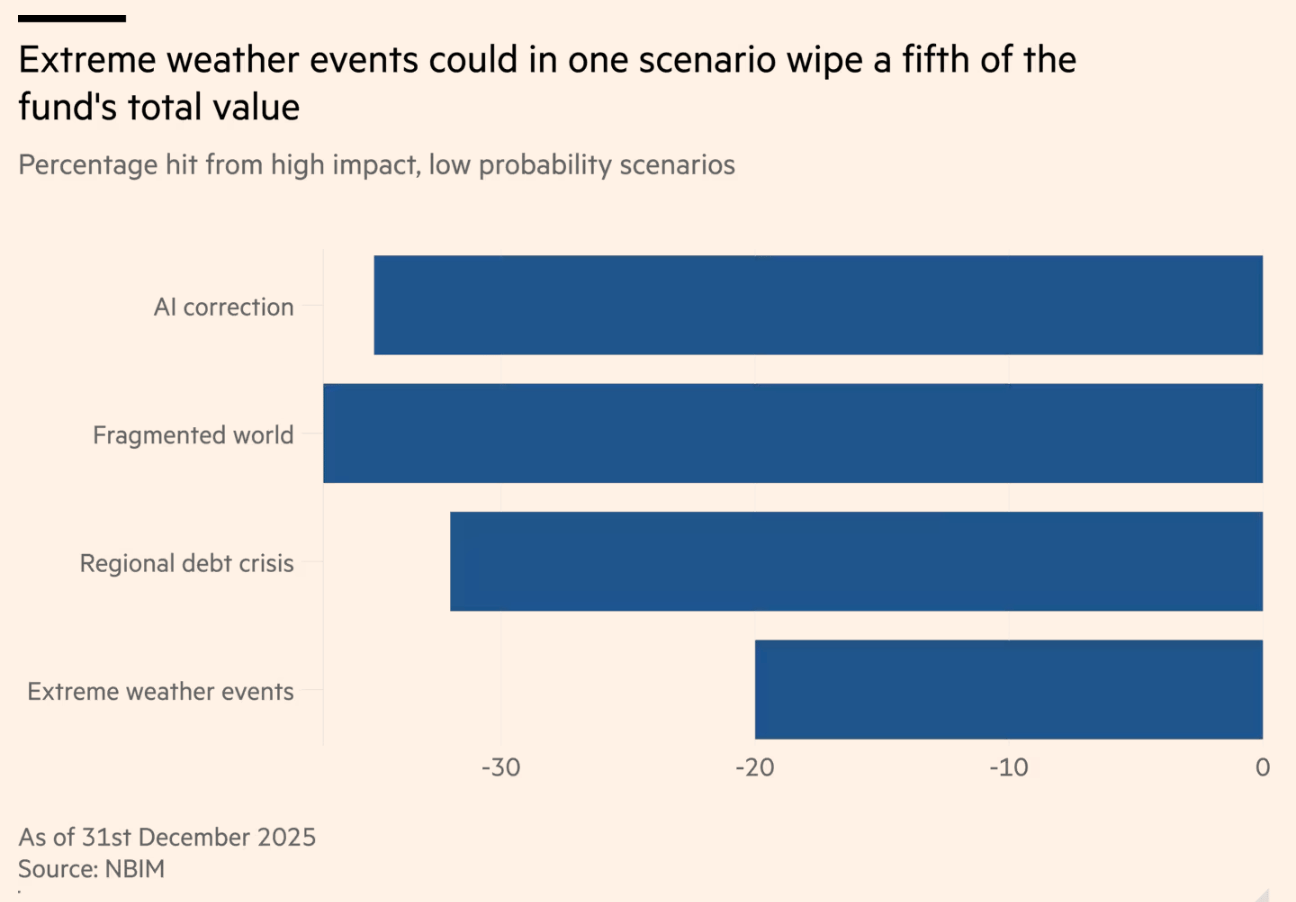

Source & Credit: NBIM

🇳🇴 Norway’s $2tn sovereign wealth fund warned that extreme climate shocks and a sharp correction in AI valuations pose major risks to its portfolio, with new stress tests showing a severe climate event could cut 24% from its equity holdings and an AI crash could wipe out 53%. Looking at the full portfolio, the biggest overall threat comes from geopolitical and economic fragmentation, which could erase 37% of value, followed by AI-related shocks and climate impacts. The fund said climate risks are increasingly relevant to financial markets, noting that extreme weather could disrupt food supplies, fuel inflation and compound other crises, and acknowledged rising exposure to fires, floods and heat across its investments.

📑 Wells Fargo Wealth & Investment Management launched an in-house proxy voting system, reducing its reliance on external proxy advisory firms. The move follows growing political scrutiny of proxy advisors over ESG and DEI issues and positions Wells Fargo alongside JPMorgan in taking direct control of voting based on its own policies focused on clients’ long-term economic interests, supported by Broadridge’s technology platform.

📈 Moody’s forecasts transition-labelled bonds as the fastest-growing segment of the sustainable bond market in 2026, driven by demand to finance decarbonization in hard-to-abate sectors and the rollout of clearer standards and taxonomies. Overall, labelled bond issuance is expected to stay flat at around $900 billion, with green bonds dominating at $530 billion, while transition bonds are projected to nearly double to $40 billion, supported by maturing bonds, adaptation financing needs, and growing scrutiny of sustainability-linked structures.

Funds

📈 Voyager Ventures raised $275 million for its second fund to back early-stage energy, industrial, and climate technology companies in North America and Europe. Fund II will focus on foundational technologies across energy systems, advanced manufacturing, critical materials, AI-driven optimization, mobility, and carbon management.

📈 Stella appointed responsAbility to manage a €200 million private equity impact fund focused on UN SDG-aligned investments in emerging markets. The long-term strategy targets growth-stage companies across Africa, Asia and Latin America, aiming to improve living standards, create jobs and support environmentally sustainable business models.

Acquisitions

📊 Carbon accounting startup Zevero acquired UK-based sustainability consultancy Inhabit to expand advisory capabilities and scale delivery. Founded in 2019, Inhabit provides carbon measurement, reporting, and decarbonization planning, with customers moving to Zevero through phased onboarding. The deal gives Inhabit clients access to Zevero’s AI-powered platform for more automated reporting and clearer data visualization.

🤝🏻 Bureau Veritas acquired Italian sustainability consultancy SPIN360, strengthening its fashion and luxury offering across LCA, carbon footprinting, supply chain monitoring, and ESG reporting. Founded in 2009, SPIN360 supports companies advancing environmental and social responsibility, with the deal aligning with Bureau Veritas’ LEAP | 28 strategy to combine advisory, certification, and auditing into integrated sustainability solutions for premium brands.

Startup funding rounds

⚡️ Redwood Materials closed its Series E at $425 million. Founded in 2017 by Tesla co-founder JB Straubel, the company builds large-scale energy storage systems and supplies domestically produced lithium, nickel, cobalt, copper and other key materials.

🌊 Ocean climate startup Gigablue raised $20 million in Series A. Founded in 2022, the company will use the funding to scale its marine-based carbon removal technology, which captures CO₂ through phytoplankton growth and stores it in the deep ocean.

⚡️ GlassPoint raised $20 million in a funding round. Founded in 2009, New York-based GlassPoint develops solar technology designed to produce industrial process heat at scale.

🟢 Co-reactive raised €6.5 million in seed funding. Founded in 2024 in Germany, the climate-tech startup converts captured CO₂ and natural minerals into high-performance supplementary cementitious materials that permanently store carbon while reducing clinker use in cement.

🟢 Carbonaide raised €3.7 million. Founded in 2022, Finland-based Carbonaide has developed a technology for mineralizing CO2 and sinking it permanently into concrete, making carbon-negative concrete profitable, the company said.

Did you like today's newsletter? |

PARTNER WITH US

Increase your brand awareness and visibility by reaching the right audience and target market. Showcase your company, solutions, services, products, reports, surveys, events, or other content in front of our highly targeted audience of +6,000 Sustainability & ESG professionals. Contact us at [email protected] if you think we can partner in some way.