- Green Digest

- Posts

- What's Happening in Sustainability & ESG (20.01 - 26.01) 🌎

What's Happening in Sustainability & ESG (20.01 - 26.01) 🌎

Global investment in the energy transition hit a new record despite headwinds

This week’s read time: 8 minutes

Welcome to this edition of Green Digest, where you will get updated about everything happening in the Sustainability & ESG space in less than 10 minutes. 🌎

We go through tons of articles and data from the most reliable sources, filter & simplify them, and serve them to you in bite-sized chunks every week. 🍀

In this edition, we’ll cover:

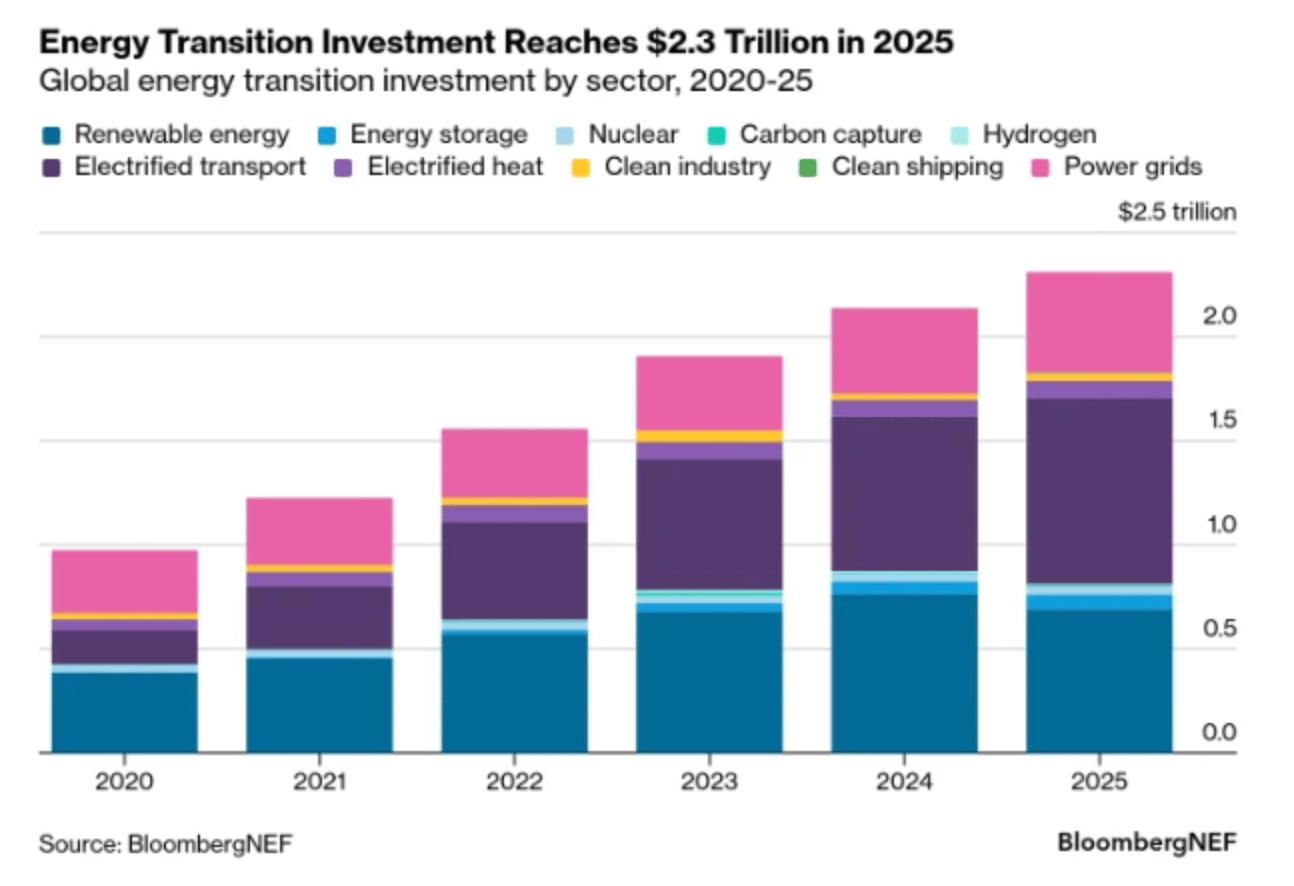

• Global investment in the energy transition reached a new record of $2.3 trillion in 2025, rising 8% year-on-year ⚡️

• This year’s WEF in Davos highlighted a shift in global priorities, with geopolitics and technological competition eclipsing climate and sustainability ambitions 🌍

• The SBTi reported that the number of companies with validated science-based climate targets surpassed 10,000 📑

• SLR acquired WAP Sustainability, while gryn and Lune merged 🤝🏻

• and other news 🌍

PRESENTED BY DitchCarbon

We all know surveying suppliers is slowing climate action. Sustainability teams spend huge amounts of time on questionnaires, losing up to 65% of their day to reporting instead of cutting emissions.

Today, DitchCarbon launches an AI-powered survey responder: Teams upload data once and DitchCarbon Agents handle the rest, giving all that time back to impact.

DitchCarbon has already proactively researched any public data on over 1.4m companies so chances are all you have to do to get going is claim your profile here.

THIS WEEK’S TOP NEWS

Regulatory Oversight & Industry Insights

⚡️ Global investment in the energy transition reached a new record of $2.3 trillion in 2025, rising 8% year-on-year despite trade disruptions, geopolitical tension, and policy headwinds. BloombergNEF’s latest Energy Transition Investment Trends report shows that capital continued to flow into clean technologies at scale, underscoring the resilience of the transition even as growth slowed from the rapid expansion seen earlier in the decade. Electrified transport dominated investment for the first time, with $893 billion spent on electric vehicles and charging infrastructure, up 21% from 2024, while renewable energy attracted $690 billion and power grids surged to $483 billion as networks raced to accommodate new demand and generation.

Source & Credit: BloombergNEF

Regionally, China remained the single largest market at $800 billion, but recorded its first decline in energy transition investment since 2013 as power market reforms dampened renewable deployment, even as EV investment stayed strong. The EU increased investment by 18% to $455 billion on the back of broad-based gains across renewables, grids, storage, and transport, and the US edged up 3.5% to $378 billion despite a turbulent policy environment. Taken together, investment across the US, EU, and UK exceeded China’s total, highlighting a more competitive and diversified global race to deploy clean energy.

🇪🇺 In related news, wind and solar generated 30% of the EU’s electricity in 2025, overtaking fossil fuels for the first time, which supplied 29%, according to Ember. Renewables and nuclear together now produce 71% of EU power, driven by a 19% rise in solar capacity and record lows for coal, whose share fell to 9.2%. European energy ministers from nine countries also launched the Hamburg Declaration at the North Sea Summit 2026, committing to jointly develop up to 100 GW of offshore wind in the North Sea as part of a wider 300 GW by 2050 goal. The plan prioritizes cross-border “cooperation projects” such as hybrid wind farms and shared grids to cut costs, boost energy security and lower prices, backed by new financing frameworks, coordinated tenders and investment de-risking tools.

Source & Credit: EMBER

PRESENTED BY ECONOMIST IMPACT

Economist Impact’s 11th annual Sustainability Week | March 2nd - 4th 2026, London

Economist Impact’s 11th annual Sustainability Week brings together leaders to share case studies, insights, and ideas to drive action on sustainability. With more than 400 speakers, 2,500 in-person attendees, and 80 case studies, the 11th annual Sustainability Week tackles sustainability-related business challenges, finds solutions, and gets results. Meet the most influential industry leaders, policymakers, and innovators.

Learn more on the event website and register here. Green Digest readers can save 20% on registration using the discount code GD-SW20.

MORE INTERESTING NEWS

Latest developments, reports, insights, and trends

Flags fly outside the Congress Centre during the World Economic Forum annual meeting in Davos, Switzerland | Credit: Denis Balibouse / Reuters

🌍 This year’s World Economic Forum in Davos underscored a clear shift in global priorities, with geopolitics, power realignments, and technological competition overshadowing climate and sustainability ambitions. Climate featured less as a rallying point for decarbonization and more as a question of resilience and adaptation, reflecting a growing acceptance among political and corporate leaders that severe warming is increasingly unavoidable. Energy security remained central, but the narrative diverged sharply: US President Donald Trump used his platform to promote fossil fuels, criticize renewables and ESG policies, and frame Europe’s climate agenda as a drag on competitiveness, while surveys and expert commentary showed environmental risks slipping down short-term priority rankings, overtaken by geopolitics, AI governance, and trade tensions. The overall mood suggested a move away from collective climate leadership toward managing climate impacts amid political fragmentation.

At the same time, Davos highlighted a widening rift between major powers on climate and energy policy, with new alliances forming outside US leadership. Canada’s Prime Minister Mark Carney called for flexible “coalitions of the willing,” Europe reiterated its commitment to renewables and nuclear for energy independence, and China positioned itself as a stable clean energy leader, defending its dominance in wind and solar and emphasizing its role in cutting emissions globally through clean tech exports. While climate was no longer the headline issue, many executives signaled that sustainability efforts will continue more quietly, shaped by geopolitics rather than global consensus. The result is a fragmented but evolving climate landscape, where decarbonization may advance through new blocs even as political discourse lags behind the physical realities of climate risk.

📑 The Science Based Targets initiative (SBTi) said the number of companies with validated science-based climate targets surpassed 10,000, up nearly 40% from early 2025 after more than 2,800 new validations last year. Companies with approved targets now represent over 40% of global market capitalization across 90+ countries, with especially strong growth in Asia led by Japan, even as SBTi faces rising political scrutiny in the US alongside CDP.

🇺🇸 Texas Attorney General Ken Paxton issued a legal opinion declaring DEI programs embedded in more than 100 state laws unconstitutional and warning that private companies using DEI frameworks could face legal liability. The 74-page opinion targets DEI initiatives across schools, state and local governments, and potentially the private sector, calling for the immediate abolition of DEI and affirmative action programs and signaling investigations into entities that continue such practices, adding to mounting political and legal pressure on corporate DEI following recent federal actions and court rulings.

WHAT ARE COMPANIES DOING?

Corporate sustainability, new tools and services & companies in the news

🛩️ TotalEnergies said it will scale back planned investments in sustainable aviation fuel, with CEO Patrick Pouyanné predicting the EU will weaken its SAF mandates, similar to recent rollbacks in vehicle emissions rules. Speaking at Davos, Pouyanné argued that costly biofuels depend on regulation to create demand, criticized the EU’s sharp jump to a 6% SAF requirement by 2030, and said uncertainty over targets makes large investments risky, adding that renewables like solar and wind offer cheaper CO₂ abatement than biofuels.

🟢 Engie will invest up to £70 million in a new UK biomethane plant after securing a 10-year offtake agreement with PepsiCo UK starting in 2027. The deal will supply 60 GWh of biomethane annually, cutting PepsiCo UK’s emissions by more than 10,900 tonnes per year, while expanding Engie’s biomethane production capacity in the UK and supporting decarbonization of hard-to-abate sectors using existing gas infrastructure.

🟢 Charm Industrial signed a long-term carbon removal offtake with TD Bank covering 44,000 tonnes over 10 years starting in 2029, using Charm’s bio-oil sequestration and biochar technologies. The deal supports TD’s climate strategy and will help fund Charm’s expansion into Canada, where part of the removals will be sourced, as the company looks to scale durable carbon removal while delivering co-benefits such as wildfire residue management, well remediation, and local economic impact.

⚡️ Exowatt launched ExoRise, a new business unit providing turnkey powered land and renewable energy infrastructure for hyperscale AI data centers to meet surging US electricity demand. ExoRise pairs powered land with Exowatt’s solar-and-thermal storage technology to speed time-to-power and reduce grid interconnection delays, with pilot projects in the US Southwest expected to go live by end-2026, following the company’s $50 million raise in late 2025.

📊 Schneider Electric launched Resource Advisor+, an AI-powered platform that unifies emissions, energy management, supply chain decarbonization, and sustainability data into a single system. The platform debuts with Carbon Performance for auditable Scope 1–3 emissions management and Supply Chain tools to engage suppliers, with additional modules for climate risk, reporting, and energy efficiency planned later this year.

EVERYTHING FINANCE

Sustainable finance, funding rounds, acquisitions & private equity deals

🇭🇰 The Hong Kong Monetary Authority released Phase 2A of the Hong Kong Taxonomy for Sustainable Finance, expanding it beyond green activities to include climate transition and adaptation, and more than doubling covered activities and sectors. The update introduces Green, Transition and Exclusion categories aligned with a 1.5°C pathway, adds time-bound transition criteria, launches a new climate adaptation category, and expands sector coverage from 4 to 6, with further phases already planned.

📈 Allianz Global Investors raised $690 million at the first close of its Allianz Credit Emerging Markets (ACE) strategy, targeting $1 billion to channel private capital into climate and development projects in emerging markets. Using a blended finance structure with first-loss protection from development finance institutions, the fund will invest in private debt across low-carbon sectors such as clean energy, sustainable infrastructure, and agriculture in Africa, Latin America, and Asia-Pacific.

📈 responsAbility Investments raised $460 million at the fifth close of its Asia Climate Strategy, nearing its $500 million target to invest in low-emission technologies across Asia. Launched in 2023, the fund targets up to 16 million tons of CO2 reductions through investments in renewables, battery storage, e-mobility, energy efficiency, and the circular economy

Acquisitions

🤝🏻 SLR acquired WAP Sustainability to expand its sustainability consulting, software, and ESG data capabilities, strengthening its position in high-growth markets. The deal adds deep expertise in life cycle assessment, environmental product declarations, carbon accounting, and ESG advisory across sectors such as building products, packaging, textiles, electronics, and consumer goods, enabling SLR to tackle larger, more complex global sustainability projects.

🤝🏻 gryn and Lune merged to create an end-to-end logistics emissions platform combining shipment-level data collection, automated CO2 calculations, insights, and decarbonization tools. The combined company serves 100+ customers across millions of shipments, aims to replace fragmented, manual Scope 3 reporting with automated CO2 intelligence, and will operate under the Lune brand, with Lune’s CEO continuing to lead.

Startup funding rounds

⚡️ German climate fintech Cloover raised €1 billion in financing to scale its AI-powered platform that finances residential clean energy systems across Europe. The funding, including €1.02 billion in debt and €18.8 million in Series A equity, will support expansion into new European markets and help installers and households access capital for solar, batteries, heat pumps, and EV chargers, lowering upfront costs and accelerating Europe’s decentralized energy transition.

🪨 Zanskar raised $115 million in a Series C round to scale its AI-powered geothermal discovery platform and develop newly identified power plants across the Western US. Founded in 2021, the company uses AI, computational geoscience, and modern drilling to cut exploration risk and costs.

Did you like today's newsletter? |

PARTNER WITH US

Increase your brand awareness and visibility by reaching the right audience and target market. Showcase your company, solutions, services, products, reports, surveys, events, or other content in front of our highly targeted audience of +6,000 Sustainability & ESG professionals. Contact us at [email protected] if you think we can partner in some way.