- Green Digest

- Posts

- What's Happening in Sustainability & ESG (10.02 - 16.02) 🌎

What's Happening in Sustainability & ESG (10.02 - 16.02) 🌎

US climate regulation after the repeal of the Endangerment Finding

This week’s read time: 8 minutes

Welcome to this edition of Green Digest, where you will get updated about everything happening in the Sustainability & ESG space in less than 10 minutes. 🌎

We go through tons of articles and data from the most reliable sources, filter & simplify them, and serve them to you in bite-sized chunks every week. 🍀

In this edition, we’ll cover:

• US climate regulation after the repeal of the Endangerment Finding 🇺🇸

• EUDR stays intact; EU approves a 90% GHG reduction target by 2040 🇪🇺

• GRI launched a new practical guide to help companies strengthen biodiversity reporting 📑

• Workiva survey: 43% of companies became more cautious in external communication while progressing internally, 47% grew more open, with only 3% pausing efforts last year 📑

• The European Central Bank fined Crédit Agricole for failing to comply with climate and environmental risk requirements 🏦

• and other news 🌍

PRESENTED BY ECONOMIST IMPACT

Economist Impact’s 11th annual Sustainability Week | March 2nd - 4th 2026, London

Economist Impact’s 11th annual Sustainability Week brings together leaders to share case studies, insights, and ideas to drive action on sustainability. With more than 400 speakers, 2,500 in-person attendees, and 80 case studies, the 11th annual Sustainability Week tackles sustainability-related business challenges, finds solutions, and gets results. Meet the most influential industry leaders, policymakers, and innovators.

Learn more on the event website and register here. Green Digest readers can save 20% on registration using the discount code GD-SW20.

THIS WEEK’S TOP NEWS

Regulatory Oversight & Industry Insights

🇺🇸 US climate regulation faces its biggest reversal in 15 years, as President Trump and the EPA repealed the 2009 Greenhouse Gas Endangerment Finding, eliminating the legal basis for federal greenhouse gas limits across vehicles, power plants, and oil and gas. Here are the key developments:

A 16-year strategy culminates in repeal

The endangerment finding, which determined that greenhouse gases harm public health and enabled national emissions standards, has long been a target of conservative legal circles. For over a decade, a network of lawyers and policy advisers, backed by groups such as the Heritage Foundation, prepared legal arguments and draft executive actions for a future Republican administration. With Trump back in office, that groundwork moved quickly into execution. The administration argues the Clean Air Act was never intended to regulate global pollutants like CO₂ and cites recent Supreme Court rulings limiting agency authority.

Regulatory whiplash hits corporate planning

The repeal immediately removes federal authority to enforce vehicle emissions standards and is projected by the EPA to save $1.3 trillion in compliance costs. But companies that invested heavily in emissions reductions now face policy volatility, stranded asset risks, and the possibility of a fragmented state-by-state framework replacing a single national standard. Investors warn that stop-start climate policy complicates capital allocation and increases transition uncertainty, especially for multinationals still subject to global disclosure.

Supreme Court battle looms

Legal challenges are expected swiftly, setting up what could become a defining Supreme Court case on whether greenhouse gases can be regulated under the Clean Air Act. If upheld, the repeal could significantly limit future presidents’ ability to regulate emissions without new congressional authority, reshaping the architecture of US climate governance.

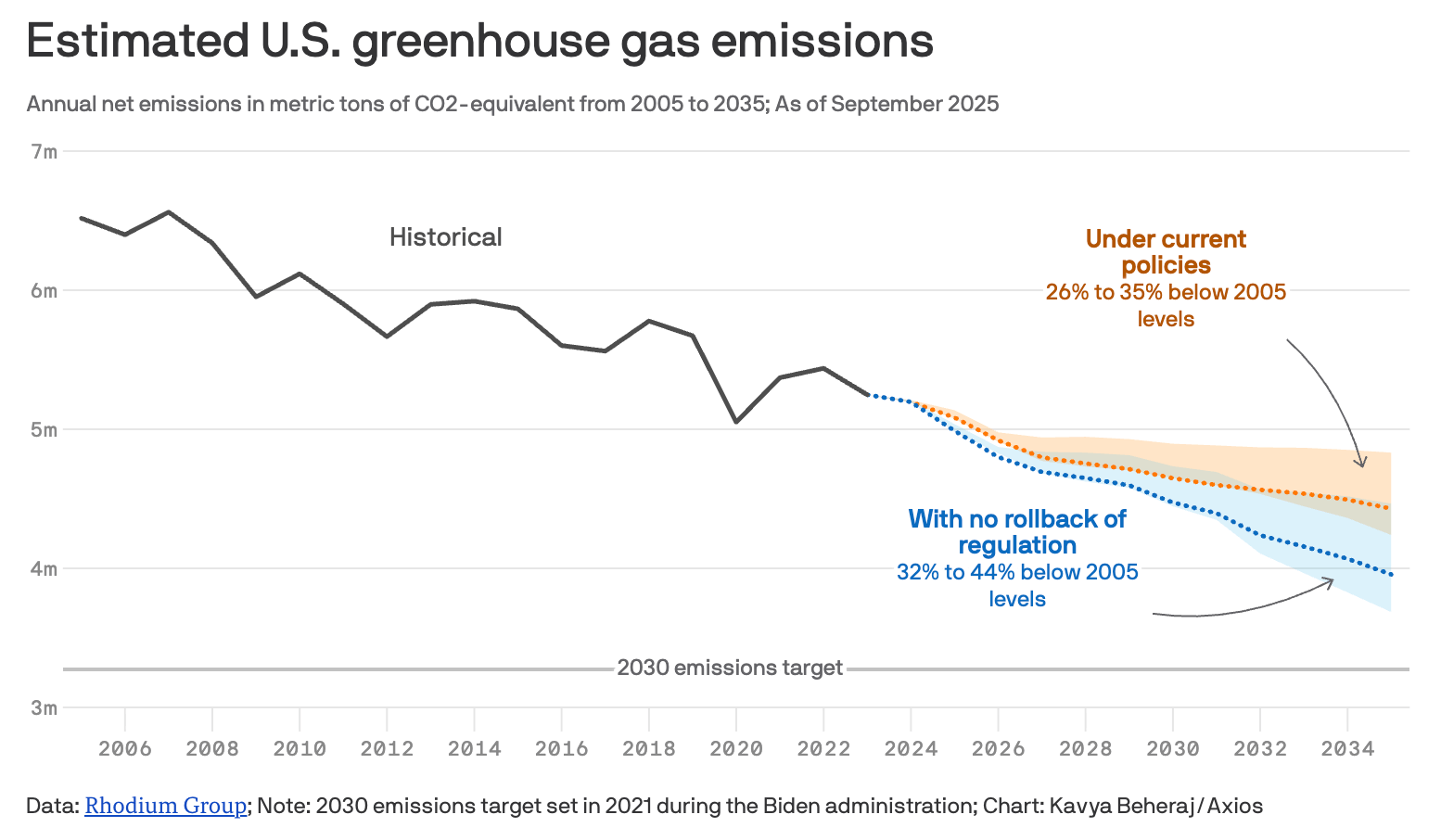

Markets, not mandates, may steer the transition

Despite the symbolic and legal significance, analysts say the US energy transition is unlikely to reverse. Cheap renewables, cleaner-than-coal natural gas, and corporate net-zero commitments continue to drive emissions downward. While federal rollbacks may slow progress, market forces and state-level policies remain influential.

States move in the opposite direction

The New York State Senate approved legislation requiring companies with over $1 billion in revenue doing business in the state to disclose Scope 1 and 2 emissions from 2028 and Scope 3 from 2029, closely mirroring California’s SB 253. Meanwhile, California’s climate disclosure laws begin phasing in from 2026, with Scope 1 and 2 reporting due by August, while SB 261 climate risk reporting remains paused pending litigation. The result: even as federal authority narrows, state-level and global disclosure regimes continue expanding.

MORE INTERESTING NEWS

Latest developments, reports, insights, and trends

🇪🇺 The EU’s key developments:

The 2040 target is set at 90% as flexibility enters the framework

The European Parliament approved amendments to the EU Climate Law establishing a 90% GHG reduction target by 2040. The agreement allows up to 5% of reductions to come from international carbon credits from 2036, requiring at least 85% domestic cuts, and introduces biennial reviews that could recalibrate the pathway based on economic and technological conditions. The EU has already reduced emissions 37% since 1990, while ETS2 reforms were delayed by one year pending Council approval.

EUDR stays intact, with targeted simplifications ahead

The Commission confirmed it will not reopen the core EU Deforestation Regulation, set to apply from December 2026, but will introduce targeted simplifications and technical adjustments. A delegated act will amend the product list, potentially adding items such as palm oil-based soap and instant coffee, while clarifications are expected on IT systems, smallholder obligations, e-commerce and due diligence rules. The country risk benchmarking review has been postponed.

Ecodesign rules ban the destruction of unsold textiles

Under the Ecodesign for Sustainable Products Regulation, the Commission adopted new rules prohibiting the destruction of unsold apparel, footwear and accessories. Large companies must comply from July 2026, with medium-sized firms following in 2030. Standardized disclosure requirements begin in 2027. The move targets the estimated 4 to 9% of unsold textiles destroyed annually in Europe, linked to 5.6 million tons of CO2, and aims to strengthen circular business models.

ETS defended as competitiveness debate intensifies

Commission President Ursula von der Leyen defended the EU Emissions Trading System and urged member states to reinvest more carbon revenues into industrial innovation. While 100% of ETS revenues are reinvested at the EU level, less than 5% is redirected nationally toward decarbonization. Emissions in covered sectors have fallen 39% since 2005 alongside 71% economic growth.

At the same time, BASF and other industry leaders called the EU ETS “obsolete,” blaming high carbon costs for weakening competitiveness. Leaders, including Merz and Macron, signaled openness to revisions or delays, and allowance prices softened amid debate over free allocations. Meanwhile, ArcelorMittal backed recent CBAM reforms, linking them to a €1.3bn low-carbon steel investment in France.

📑 GRI launched a new practical guide to help companies strengthen biodiversity reporting using the updated GRI 101: Biodiversity 2024 Standard, as IPBES warns business-as-usual is accelerating nature loss. The free resource includes case studies and guidance on assessing impacts across operations and supply chains, integrating nature into governance, and improving location-specific disclosures.

⚡️ The IEA’s Electricity 2026 report forecasts global power demand to grow by more than 3.5% per year through 2030, rising at least 2.5 times faster than overall energy demand, driven by industry, EVs, air conditioning, data centres, and AI. Renewables and nuclear are set to supply 50% of global electricity by 2030, up from 42% today, with solar PV leading growth, while gas generation also expands and coal declines to 2021 levels. Despite the shift, power-sector CO₂ emissions are expected to remain roughly flat to 2030.

PRESENTED BY SUSTAINABILITY MAGAZINE

Sustainability LIVE: The US Summit returns on 21-22 April, bringing together leaders who are driving real progress on sustainability across their organisations. With over 1,000 in-person attendees, the two-day event delivers the insights, connections, and practical takeaways needed to move from intention to impact. The agenda features 50+ speakers, 10 focused content themes, and four executive workshops designed to support action on climate, circularity, responsible growth, and culture change.

WHAT ARE COMPANIES DOING?

Corporate sustainability, new tools and services & companies in the news

📑 Workiva found that most companies continued advancing sustainability initiatives over the past year despite regulatory uncertainty and broader pushback. 43% became more cautious in external communication while progressing internally, and 47% grew more open, with only 3% pausing efforts. Financial performance is now the top driver of sustainability, while 94% of investors consider ESG in decisions and 97% view financial and non-financial data as essential for long-term risk assessment.

📑 Companies are scaling back positive impact claims in their second CSRD reports, with most firms reducing or removing such disclosures after clearer guidance distinguished genuine additional impacts from simple mitigation actions. Of 12 companies reporting so far, seven cut their positive claims and none increased them; Tryg removed all five prior impacts, Vestas reduced from 12 to five, and others like Ørsted, Carlsberg, and Novo Nordisk trimmed disclosures. Updated EFRAG guidance clarified that reducing harm does not qualify as a positive impact.

🟢 ArcelorMittal plans to build a €1.3 billion electric arc furnace in Dunkirk, France, to decarbonize its European steel production. The 2-million-ton facility, set to start in 2029, will emit about 0.6 tons of CO2 per ton of steel, roughly three times less than a blast furnace.

✈️ SkyNRG secured financing to build the Netherlands’ first large-scale sustainable aviation fuel plant, with KLM as primary off-taker. The Delfzijl facility will produce 100,000 tonnes of SAF annually plus 35,000 tonnes of biobased by-products using the HEFA pathway, with startup expected in 2028. SkyNRG estimates lifecycle emissions cuts of 80%, rising above 90% as renewable energy use expands.

🔋 BNP Paribas and Eclipse formed a partnership to accelerate Battery Energy Storage Systems deployment in Europe, including a strategic equity investment by BNP in Eclipse. The collaboration will offer tailored financing, long-term offtake agreements, and hedging solutions to reduce merchant risk and lower capital costs for BESS projects. Founded in 2022, UK-based Eclipse develops and operates utility-scale storage to stabilize grids and integrate renewables.

EVERYTHING FINANCE

Sustainable finance, funding rounds, acquisitions & private equity deals

European Central Bank (ECB) Headquarters in Frankfurt am Main, Germany | Credit: Michael Haeckl

🏦 The European Central Bank fined Crédit Agricole €7.55 million for failing to comply with climate and environmental risk requirements, citing a 75-day breach of its materiality assessment obligation in 2024. The decision, which the bank can challenge at the Court of Justice of the EU, reflects the ECB’s increasingly stringent supervision as it moves from guidance to binding rules on how banks disclose and manage climate-related risks.

In related news, the European Central Bank also reiterated its warning that diluting the ESRS will “limit the availability of meaningful data” and “hamper the comparability of disclosures across companies”. It pointed to the “numerous permanent relief measures, phase-ins and exemptions from disclosure requirements, together with the removal of some critical data points” in an opinion.

⛽ NatWest softened its fossil fuel lending policy, removing several bans on financing oil and gas firms, citing the “complexity” of the energy transition, prompting ShareAction to urge investors to oppose the bank’s chair at the upcoming AGM. The bank lifted restrictions on reserve-based lending and dealings with oil majors lacking aligned transition plans, though oil and gas exposure remains under 1% of its balance sheet and it still targets halving financed emissions by 2030.

🏛️ The US SEC is reviewing anti-greenwashing rules adopted in 2023 that set criteria for ESG-labelled investment funds. SEC Chair Paul Atkins said the amended “Names Rule,” which requires funds with ESG-focused names to invest at least 80% of assets accordingly, is under retrospective review. The move follows broader efforts to revisit Biden-era sustainable investing initiatives, citing concerns over compliance costs and effectiveness.

💶 Deutsche Bank raised €500 million in its first green bond issued under the EU’s European Green Bond standard. The EuGB framework requires proceeds to align with the EU Taxonomy and meet strict transparency and transition plan criteria. The bank will allocate funds to refinance EU Taxonomy-compliant residential real estate loans under its Green Buildings category, supporting sustainable finance and net zero objectives.

Funds

📈 Vision Ridge raised $2.4 billion at the final close of its Sustainable Asset Fund to back climate-focused real assets. The fund targets scalable platforms across energy, transportation, and agriculture. About 30% is already committed, including battery storage in Japan, clean mobility in Mexico, and an electric utility in Turks & Caicos.

📈 Eurazeo raised €175 million at the first close of its Sustainable Maritime Infrastructure II fund to support decarbonization in Europe’s maritime sector. The Article 9 fund, targeting €400 million, will provide senior secured financing to small and mid-sized shipowners across marine transport, offshore renewables, and port infrastructure.

Acquisitions

🏢 Deepki acquired energy management firm Sobre Energie to expand its capabilities in improving real estate energy performance. Founded in 2016, Paris-based Sobre Energie provides analytics, software, and energy-efficiency services for commercial and public portfolios. The deal adds physical building audits and operational expertise to Deepki’s platform.

Startup funding rounds

⚛️ Fusion startup Inertia Enterprises raised $450 million in a Series A round to commercialize laser-based fusion power. Founded in 2024, the company builds on National Ignition Facility breakthroughs that achieved net energy gain from fusion.

⚡ Energy tech startup tem raised $75 million in a Series B round to scale its electricity transaction platform. The UK-based company enables businesses to purchase renewable power directly from generators, reducing reliance on intermediaries.

✈️ HAMR raised $7 million in a Series A round to scale low-carbon fuel projects. The Melbourne-based company plans to convert forestry residues into fuels for shipping and aviation, with a project targeting 300,000 tons of low-carbon methanol annually and a facility capable of producing over 135 million liters of sustainable aviation fuel per year.

Did you like today's newsletter? |

PARTNER WITH US

Increase your brand awareness and visibility by reaching the right audience and target market. Showcase your company, solutions, services, products, reports, surveys, events, or other content in front of our highly targeted audience of +6,500 Sustainability & ESG professionals. Contact us at [email protected] if you think we can partner in some way.