- Green Digest

- Posts

- What's Happening in Sustainability & ESG (07.01 - 12.01) 🌎

What's Happening in Sustainability & ESG (07.01 - 12.01) 🌎

EU CBAM enters its definitive phase, and other news

This week’s read time: 7 minutes

Welcome to this edition of Green Digest, where you will get updated about everything happening in the Sustainability & ESG space in less than 10 minutes. 🌎

We go through tons of articles and data from the most reliable sources, filter & simplify them, and serve them to you in bite-sized chunks every week. 🍀

In this edition, we’ll cover:

• The EU’s revised Carbon Border Adjustment Mechanism (CBAM) entered its definitive phase this month 🇪🇺

• The US is withdrawing from the UN climate treaty and dozens of international climate bodies, calling them contrary to US interests 🇺🇸

• The Philippines launched mandatory IFRS-based sustainability reporting standards 🇵🇭

• EcoVadis and Amazon launched a new EU Amazon Business feature allowing B2B sellers to display EcoVadis sustainability medals and badges 🏅

• The wave of acquisition continues, with Diginex acquiring The Remedy Project and Plan A 🤝🏻

• and other news 🌍

PRESENTED BY ECONOMIST IMPACT

Economist Impact’s 11th annual Sustainability Week | March 2nd - 4th 2026, London

Economist Impact’s 11th annual Sustainability Week brings together leaders to share case studies, insights, and ideas to drive action on sustainability. With more than 400 speakers, 2,500 in-person attendees, and 80 case studies, the 11th annual Sustainability Week tackles sustainability-related business challenges, finds solutions, and gets results. Meet the most influential industry leaders, policymakers, and innovators.

Learn more on the event website and register here. Green Digest readers can save 20% on registration using the discount code GD-SW20.

THIS WEEK’S TOP NEWS

Regulatory Oversight & Industry Insights

🇪🇺 The EU’s revised Carbon Border Adjustment Mechanism (CBAM) entered into force in January 2026, following a redesign last year that removed around 90% of importers from its scope, while the Commission claims 99% of embedded emissions are still covered. The rules mark the start of CBAM’s definitive phase, requiring importers of steel, aluminium, cement, fertilisers, electricity and hydrogen to begin purchasing CBAM certificates to compensate for the embedded emissions of their imports.

Under the new system, certificate prices are linked to the EU carbon price, effectively extending the EU Emissions Trading System (EU ETS) to imports. Companies must report the embedded emissions of their products, and those without precise, third-party-verified data will have estimated default values applied, which are expected to err on the higher side. This year will be a year of operational fine-tuning for CBAM, as businesses adjust their reporting practices and shift from default values toward verified data.

While the policy is intended to protect EU manufacturers from carbon leakage and push global producers toward cleaner production, it has also drawn criticism from trading partners, including the US, China, India, and South Africa, who argue it risks protectionism and could violate WTO rules. Importers face complex emissions data requirements and added administrative costs, while exporters to the EU may need to purchase CBAM certificates priced roughly in line with the EU carbon market (€70–€100 per tonne), making reliable emissions data a commercial necessity.

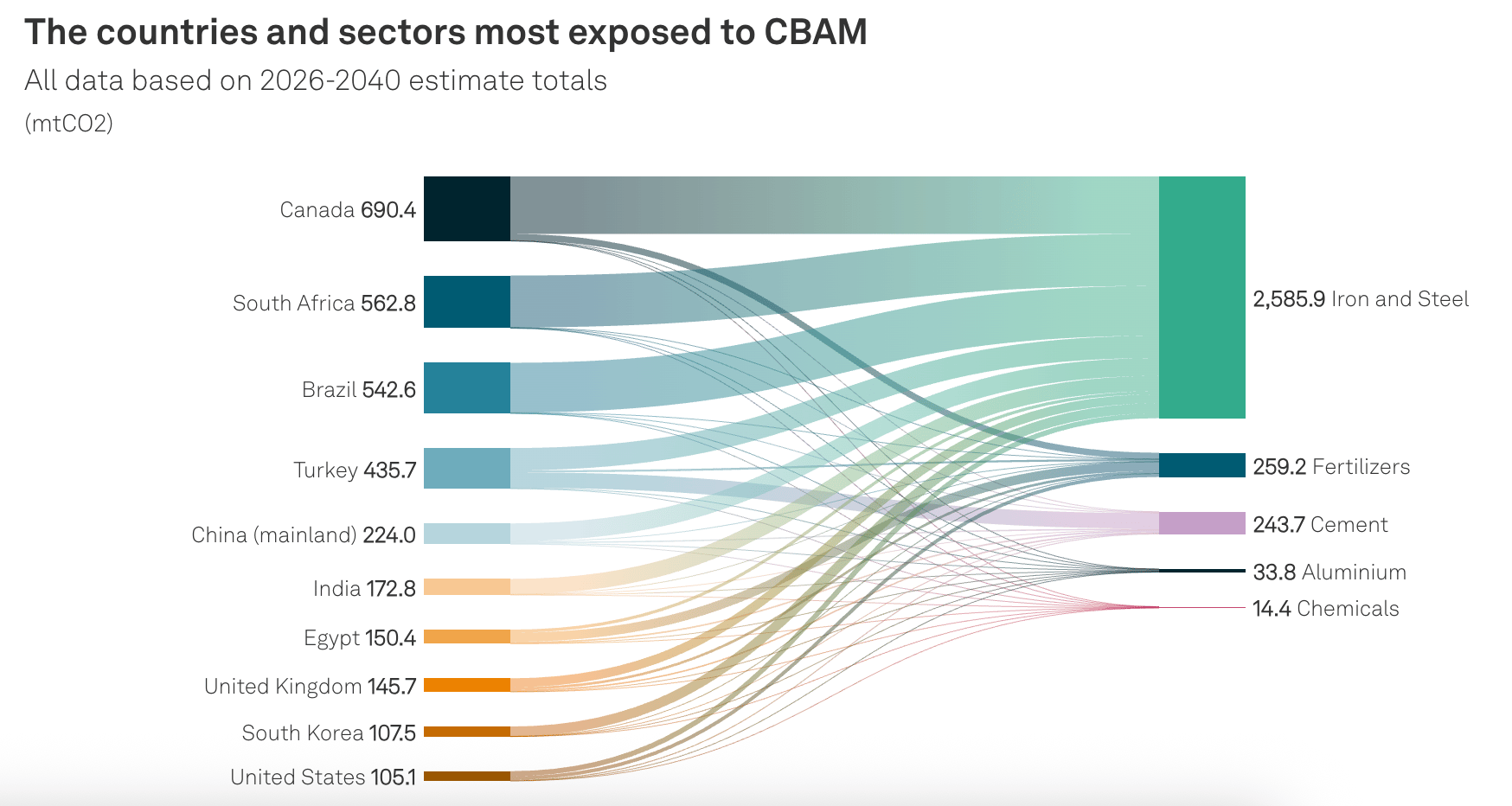

Source: S&P Global

S&P Global estimates CBAM could add $15–25 billion annually to the value of covered imports over the next decade, with iron and steel the most exposed sector, followed by aluminium, cement and fertilisers. Countries such as China, Brazil, South Africa, and Turkey are among the most affected. The EU expects CBAM to generate €1.5 billion in revenues by 2028, which will be placed into a temporary fund to support domestic industries during the transition.

Political pressure is already emerging, with France and Italy pushing to temporarily exempt fertilisers from CBAM, arguing that the levy would raise costs for already struggling European farmers. Critics warn that such exemptions risk undermining the policy’s core objective by exposing EU producers to cheaper imports from countries with weaker climate rules. The Commission has signalled that further revisions remain possible, with the next major change expected this year, when CBAM’s scope is set to expand.

Source: S&P Global

MORE INTERESTING NEWS

Latest developments, reports, insights, and trends

A thermometer reads 39°C at the UNFCCC headquarters in Bonn, Germany | Credit: REUTERS/Wolfgang Rattay

🇺🇸 President Donald Trump announced that the US is withdrawing from the UN climate treaty and dozens of international climate, clean energy, and sustainable development organizations, calling them contrary to US interests. The move, which would make the US the first country to exit the UNFCCC and includes withdrawals from bodies such as the IPCC and IRENA, has drawn sharp criticism from international leaders and environmental groups, who warn it will weaken US economic competitiveness, global influence, and resilience as clean energy investment accelerates worldwide.

🇵🇭 The Philippine Securities and Exchange Commission adopted new sustainability and climate disclosure standards aligned with the IFRS ISSB framework, laying the groundwork for mandatory reporting by large and listed companies. The rules will be rolled out in phases starting in 2027 for the largest listed firms based on 2026 data, expanding to smaller listed and large non-listed companies by 2029, and include requirements such as limited assurance on Scope 1 and 2 emissions, alongside transitional reliefs like delayed Scope 3 reporting to ease implementation.

WHAT ARE COMPANIES DOING?

Corporate sustainability, new tools and services & companies in the news

🏅 EcoVadis and Amazon launched a new feature on the Amazon Business marketplace in the EU that lets B2B sellers display their EcoVadis sustainability medals and badges, allowing buyers to filter and prioritize suppliers based on verified sustainability performance. The EU rollout responds to growing regulatory and customer pressure for supply chain transparency and aims to make sustainable procurement easier by integrating independent sustainability ratings directly into purchasing decisions.

⚡️ Meta and TerraPower agreed to deploy up to eight advanced Natrium nuclear reactors, supplying as much as 2.4 GW of carbon-free power to support Meta’s growing AI-driven energy demand. Under the deal, Meta will fund early development of two Natrium units and secure rights to energy from up to six more, with initial deliveries expected from the early 2030s, marking Meta’s largest commitment to advanced nuclear technology as it pursues net-zero goals amid rising data center electricity needs.

⏪ UK engineering and consultancy firm Ricardo dropped its SBTi climate targets after concluding there is no economically or technically viable path to cut emissions beyond its current 80% reduction. The firm cited abatement costs rising to around £7,000 per tonne of CO₂e, limited availability of credible carbon credits, policy uncertainty, and weak market demand for clean technologies as key barriers to reaching the 90% reduction required under its SBTi commitment.

⛽️ bp and Corteva launched Etlas, a 50:50 joint venture to produce seed-based feedstocks for biofuels such as sustainable aviation fuel and renewable diesel, targeting rapidly rising demand this decade. The venture will use oil from crops like sunflower, mustard, and canola grown on existing farmland between food crop cycles, aiming to start supplying feedstock in 2027 and reach around 1 million tonnes annually by the mid-2030s.

EVERYTHING FINANCE

Sustainable finance, funding rounds, acquisitions & private equity deals

The JPMorgan Chase & Co. building in New York | Credit: REUTERS/Eduardo Munoz

📑 JPMorgan Asset Management will stop using third-party proxy advisory firms for US proxy voting and instead rely on its own AI-powered platform, becoming the first major investment firm to take voting fully in-house. The firm will use Proxy IQ on its Spectrum platform to analyze data from more than 3,000 annual meetings, a move that comes amid heightened political and regulatory scrutiny of proxy advisors like ISS and Glass Lewis over their influence on ESG and shareholder voting.

An SEC official also said investment advisers may soon rely on AI for proxy voting as a practical alternative to traditional proxy advisory firms. Brian Daly, Director of the SEC’s Division of Investment Management, described agentic AI as a “near-term reality” that could help advisers handle the scale and complexity of proxy voting, provided it meets fiduciary standards around transparency, auditability, and oversight.

📈 Standard Chartered issued its first-ever green bond, raising €1 billion to finance renewable energy, green buildings, and other climate-focused projects across Asia, Africa, and the Middle East. The green-only issuance was nearly four times oversubscribed and will support high-impact projects in emerging markets, where the bank says sustainable finance delivers outsized emissions reduction and resilience benefits compared to developed economies.

📈 Impact investor Acumen raised $250 million in blended capital through its Hardest-to-Reach Initiative to expand clean and affordable energy access across sub-Saharan Africa. The initiative combines public, private, and philanthropic funding to reach nearly 70 million people in 17 countries, support first-time energy access for 50 million users, and avoid 4 million tonnes of CO₂ emissions.

⚡️ HASI will invest up to $500 million in a joint venture with Sunrun to finance and develop residential solar and battery systems across the US. The partnership aims to support more than 40,000 home energy systems totaling over 300 MW.

Acquisitions

🤝🏻 Sustainability RegTech firm Diginex acquired human rights advisory The Remedy Project to strengthen supply chain due diligence and remediation capabilities amid tightening global regulations. Diginex also acquired Plan A for €55 million, combining ESG reporting, carbon accounting and decarbonization into a single end-to-end sustainability platform, while adding Visa and Deutsche Bank as shareholders and strengthening Diginex’s European footprint alongside Plan A’s expansion in Asia and North America.

🤝🏻 Blackstone Energy Transition Partners acquired environmental testing and compliance services provider Alliance Technical Group (ATG) to expand its exposure to emissions monitoring and energy transition infrastructure. The deal positions Blackstone to benefit from rising electricity demand and tighter environmental regulation.

Startup funding rounds

⚡️ Aspen Power raised $200 million from Deutsche Bank to accelerate its US distributed solar and storage projects. The capital strengthens the company’s ability to scale development and meet growing demand for clean, decentralized energy.

🛩️ Aether Fuels raised $15 million in convertible note financing to advance its first commercial-scale sustainable aviation fuel facility in Singapore. The funding will support Project Beacon, a 50-barrel-per-day plant using Aether’s Aurora technology to convert waste gases and biomethane into CORSIA-certified SAF.

🟢 Equitable Earth raised €12.6 million to scale its certification programme for high-integrity nature-based carbon projects. The company aims to make carbon markets more trusted, transparent, and scalable following approval of its standard under the ICVCM’s Core Carbon Principles.

🌾 Biographica raised £7 million in seed funding to accelerate the use of AI in developing climate-resilient, high-yield, and nutritious crops. The London-based startup will use the capital to expand its AI platform, speed up genetic trait discovery, and deepen partnerships.

Did you like today's newsletter? |

PARTNER WITH US

Increase your brand awareness and visibility by reaching the right audience and target market. Showcase your company, solutions, services, products, reports, surveys, events, or other content in front of our highly targeted audience of +6,000 Sustainability & ESG professionals. Contact us at [email protected] if you think we can partner in some way.