- Green Digest

- Posts

- Interview Series: Matt Ellis

Interview Series: Matt Ellis

A closer look at the world’s most widely adopted sustainability data platform for real estate

This week’s read time: 5 minutes

Welcome to the Green Digest Interview Series, our weekly feature showcasing conversations with the industry’s leading voices - CSOs, sustainability directors, and other senior professionals shaping the sustainability landscape. Each edition dives into their professional journeys, hands-on insights, and outlook on the challenges and opportunities defining corporate sustainability.

These interviews are designed to be quick, insightful reads, offering you actionable takeaways and a personal glimpse into the people leading the way. Stay tuned for stories, strategies, and lessons that matter to you.

PRESENTED BY REUTERS EVENTS

Circularity Briefing: Europe Moves to Make Circular Economy a Reality

📊 86% of consumers want sustainable choices, but only 25% act.

Is your circular strategy closing the gap?

“If you make it hard… they won’t get involved,” says Alex Cramwinckel from Heineken.

With the EU Circular Economy Act approaching, implementation is everything.

What’s inside:

• EU legislation decoded by Joss Blériot (Ellen MacArthur Foundation)

• Circular strategies from H&M, Holcim, Philips & Ørsted

• Heineken’s blueprint for consumer engagement

• Interface’s proof that circularity boosts efficiency

📥 Lead the shift. Download now

PROFILE

This week’s guest:

Matt Ellis

CEO & Co-Founder of Measurabl

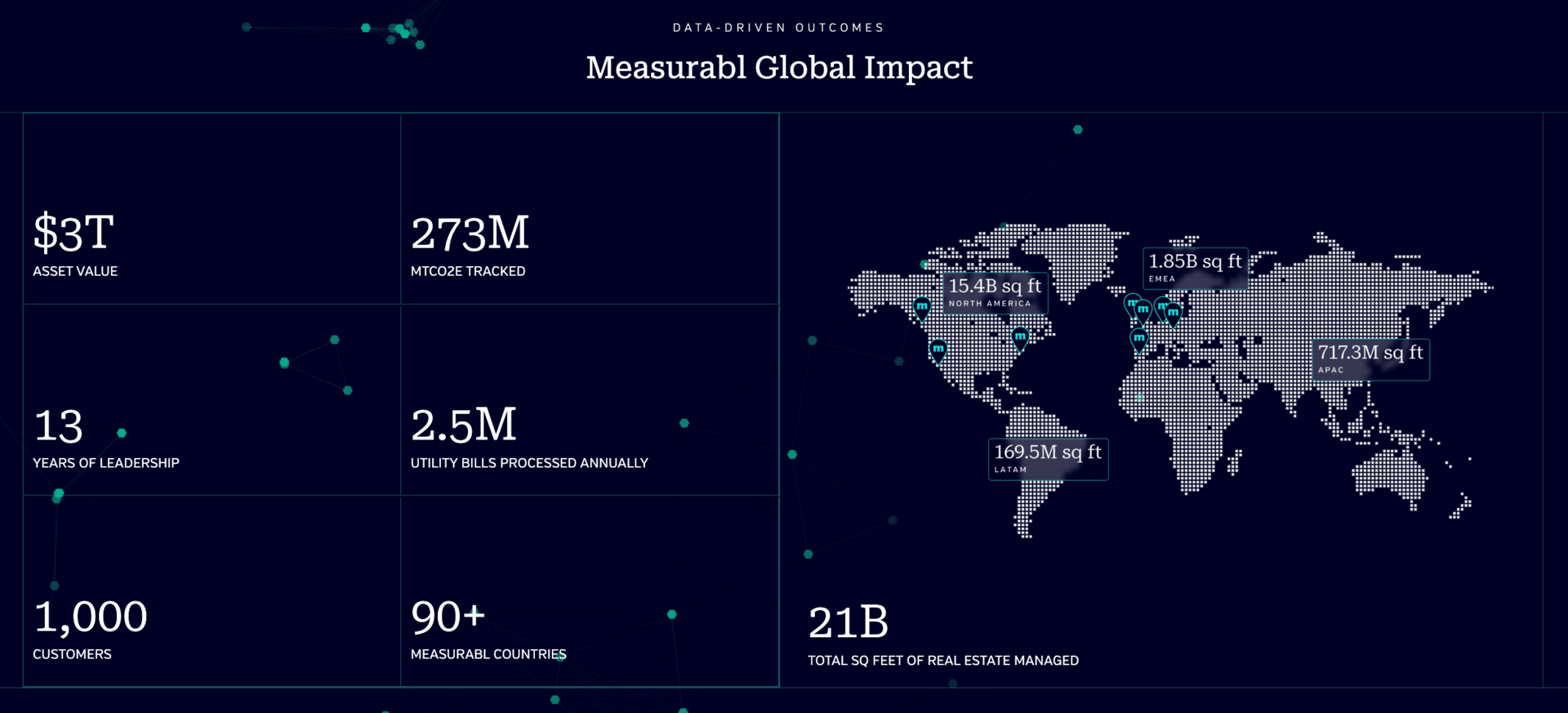

Matt Ellis is CEO and Co-founder of Measurabl, the world’s most widely adopted sustainability data platform for real estate. Today, Measurabl supports organizations in more than 90 countries—representing $3 trillion in asset value and 22 billion square feet of real estate—in measuring, managing, and acting on sustainability. Its technology streamlines reporting, reduces environmental impact, and delivers measurable business results. Recent industry recognition includes ENERGY STAR Partner of the Year for six consecutive years, ESG Data Provider of the Year by Environmental Finance (2025), and ESG Company of the Year by the CleanTech Breakthrough Awards (2024).

Before founding Measurabl, Matt spent five years at CBRE, where he led the Sustainability Practice Group, implemented the firm’s first global carbon neutrality program, and served as Director of Sustainability Solutions. He was also the youngest member of CBRE’s Global Sustainability Advisory Committee.

A widely regarded thought leader, Matt has been recognized with numerous accolades: Proptech Power 100 (Commercial Observer), Aspen Institute Fellow, New Leaders Council Fellow, “Top 50” Real Estate Executive (Real Estate Forum), “40 Under 40” (UC San Diego), and EY Entrepreneur of the Year Semi-Finalist. In 2024, the San Diego Business Journal named him one of the region’s Most Influential People. He is also the author of From Green to ESG: How Data-Driven Transparency Changed Real Estate for Good, considered a defining book on the ESG revolution in the sector.

For those new to Measurabl, what does the platform do, and why is ESG data so crucial in real estate?

Measurabl is the world’s most widely adopted sustainability data platform for real estate. Our mission is to be the catalyst for profitable, sustainable real estate, using investment-grade environmental data as the foundation. Today, more than 22 billion square feet of real estate across 90+ countries, representing more than $3T in asset value rely on Measurabl to measure, manage, disclose and transact. In only the last couple of months, over 2 billion square feet and 12,000 assets have joined our platform through our new free solution.

Energy and carbon data are now key drivers of risk and reward in real estate, directly linking sustainability efforts to efficiency, cost savings, and asset value, including transactions across lending, leasing, and securitization. Without investment-grade data, owners and investors can’t understand their exposure to regulatory or climate resilience risk, nor can they capture upside from efficiency initiatives. Performance data has become as fundamental to decision-making as rent rolls or financial statements, and our platform ensures it’s reliable and globally comparable. Our role is to measure what matters—providing objective, globally comparable metrics that bring clarity to every transaction and decision.

Credit: Measurabl

You recently launched a free sustainability software solution, and it quickly attracted over 1 billion ft² in new coverage. What is the solution about and what was the thinking behind this move?

In only the last couple of months, over 2 billion square feet and 12,000 assets across 40 countries have joined our platform through our new free solution—the fastest growth in our 13-year history. By removing paywalls to sustainability technology, benchmarks, and analytics, we’ve radically lowered barriers to better real estate. Anyone can begin collecting data, benchmarking performance, and charting a decarbonization path today with minimal effort and no cost.

This “free-first” model is unlocking adoption by owners and operators who previously couldn’t access advanced tools. With each new subscriber, our dataset grows, enriching the data and insights for everyone on the platform. The result is the open, investment-grade data layer that underpins not only reporting and compliance, but also the real estate transactions that drive value—buying, selling, financing, and underwriting.

You work with some of the biggest names in global real estate. What are some of the most common challenges you see across the sector when it comes to sustainability data, decarbonization, or compliance?

Today’s reality with interlocking regulations, investor scrutiny, and the global nature of real estate is far more complex than 25 years ago. What’s needed is a system of sustainability data designed with these realities in mind. Even with policy shifts—whether it’s the potential defunding of ENERGY STAR or evolving regulations—the core challenges and questions leaders are asking are consistent: who funds reliable infrastructure, what’s the benchmark, who governs it, how do we serve a global market, and who can innovate fast enough?

That’s why we’ve built a global, interoperable solution, available at no cost, already integrated with thousands of utilities, ENERGY STAR Portfolio Manager, RealPage, USGBC, GRESB, CRREM, and more—and supported by a bi-directional API so anyone can connect on their own terms. But technology alone isn’t enough—leaders must shift sustainability from a compliance exercise to a transactional lever. Real estate is a transaction business: buying, selling, leasing, financing, lending.

You’ve long advocated for aligning ESG performance with access to capital. Are investors and lenders actually changing their behavior, and what data matters most to them now?

Capital is already moving. Just recently, PFZW, the €220B Dutch pension fund, pulled $34 billion in mandates from BlackRock and LGIM as part of a strategy that gives equal weight to return, risk, and sustainability. Working with its investment manager PGGM—a long-time Measurabl customer—PFZW is now selecting asset managers who actively reduce portfolio emissions and align with its long-term vision.

We’re seeing this across the board. Investors and lenders are tying access to favorable financing, index inclusion, and leasing terms directly to sustainability performance. But they’re not asking for glossy reports—they want investment-grade data. Energy consumption, carbon intensity, climate risk exposure, and building certifications now sit alongside NOI and occupancy as core underwriting inputs. FTSE Russell, for example, uses our data to weight constituents in the $9B FTSE EPRA Nareit Green Index. Sustainability is now a determinant of value and risk—those with standardized data secure cheaper capital, lower risk, and higher valuations.

And finally, given your platform’s reach, you likely have visibility into macro trends before they hit the mainstream. Are there any early signals you’re seeing now that sustainability professionals should be paying more attention to?

One clear signal is the shift from static benchmarks to transactional-grade data. Energy use, GHG intensity, and climate risk exposure are already being applied directly in underwriting, valuation, and leasing decisions. Another is the rapid convergence toward a global standard, which is creating demand for consistent, real-time metrics that can move seamlessly across markets and systems versus fragmented frameworks.

What’s emerging is a call for infrastructure that is industry-led, global, open, and sustainable. Our goal is to activate the entire ecosystem—lenders, insurers, consultants, and technology partners—so sustainability data flows into every transaction and creates shared value. Real estate is already being repriced on sustainability performance. Professionals who prepare now will be tomorrow’s leaders.

Did you enjoy this interview? |

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

PARTNER WITH US

Increase your brand awareness and visibility by reaching the right audience and target market. Showcase your company, solutions, services, products, reports, surveys, events, or other content in front of our highly targeted audience of +5,000 Sustainability & ESG professionals. Contact us at [email protected] if you think we can partner in some way.