- Green Digest

- Posts

- Interview Series: Alex Friedman

Interview Series: Alex Friedman

Novata’s blueprint for private market sustainability: A conversation with CEO & Co-Founder Alex Friedman

Today’s newsletter is brought to you by

This week’s read time: 5 minutes

Welcome to the Green Digest Interview Series, our bi-weekly feature showcasing conversations with the industry’s leading voices - CSOs, sustainability directors, and other senior professionals shaping the sustainability landscape. Each edition dives into their professional journeys, hands-on insights, and outlook on the challenges and opportunities defining corporate sustainability.

These interviews are designed to be quick, insightful reads, offering you actionable takeaways and a personal glimpse into the people leading the way. Stay tuned for stories, strategies, and lessons that matter to you.

PRESENTED BY CLIMATIZE

Beyond Impact Investing: Joshua Dowdy on Installing Solar in Rural America 🌞

In this first episode of 𝗕𝗲𝘆𝗼𝗻𝗱 𝗜𝗺𝗽𝗮𝗰𝘁 𝗜𝗻𝘃𝗲𝘀𝘁𝗶𝗻𝗴, you'll meet Joshua Dowdy, a Tennessee farmer who used community funding to install solar at Liberty Hill Farms. We cover how the solar project was financed through Climatize, his experience with the REAP Grant, how solar boosts resilience in rural communities, and the positive impact of powering his farm with clean energy.

𝘑𝘰𝘴𝘩𝘶𝘢 𝘪𝘴 𝘢 𝘤𝘭𝘪𝘦𝘯𝘵 𝘰𝘧 𝘊𝘭𝘪𝘮𝘢𝘵𝘪𝘻𝘦 𝘢𝘯𝘥 𝘪𝘴 𝘯𝘰𝘵 𝘣𝘦𝘪𝘯𝘨 𝘤𝘰𝘮𝘱𝘦𝘯𝘴𝘢𝘵𝘦𝘥 𝘧𝘰𝘳 𝘴𝘩𝘢𝘳𝘪𝘯𝘨 𝘵𝘩𝘦𝘪𝘳 𝘰𝘱𝘪𝘯𝘪𝘰𝘯 𝘢𝘯𝘥 𝘦𝘹𝘱𝘦𝘳𝘪𝘦𝘯𝘤𝘦 𝘸𝘪𝘵𝘩 𝘰𝘶𝘳 𝘧𝘪𝘳𝘮. 𝘑𝘰𝘴𝘩𝘶𝘢'𝘴 𝘤𝘰𝘮𝘮𝘦𝘯𝘵𝘴 𝘮𝘢𝘺 𝘯𝘰𝘵 𝘣𝘦 𝘳𝘦𝘱𝘳𝘦𝘴𝘦𝘯𝘵𝘢𝘵𝘪𝘷𝘦 𝘰𝘧 𝘰𝘵𝘩𝘦𝘳𝘴' 𝘦𝘹𝘱𝘦𝘳𝘪𝘦𝘯𝘤𝘦𝘴 𝘸𝘪𝘵𝘩 𝘵𝘩𝘦 𝘧𝘪𝘳𝘮.

Ready to Climatize? 💚

You can join nearly 2,350 members in our growing community. As of July 2025, the projects have returned over $2.4M in principal + interest to investors. Past performance doesn’t guarantee future results. Download our free guide to begin.

*Use code GDST50 to get $50 in investment credits

Climatize Earth Securities LLC is a Funding Portal registered with the Securities and Exchange Commission (“SEC”) and Financial Industry Regulatory Authority (“FINRA”), not endorsed by the SEC and FINRA. Investing in Crowdfunded offerings involves risk. You should review the risks of a particular investment, either alone or with a personal advisor before investing, and only invest if you can afford to lose your investment.

PROFILE

This week’s guest:

Alex Friedman

CEO & Co-Founder of Novata

Alex Friedman is the CEO and co-founder of Novata, a sustainability management platform built for the private markets. Novata helps investors and companies collect, analyze, and act on ESG and carbon data, making sustainability more aligned with business performance.

Alex has spent his career advancing the idea that long-term value creation and responsible capitalism go hand-in-hand. Before founding Novata, he served as Chief Financial Officer of the Bill & Melinda Gates Foundation, where he launched its first social impact fund. He was also Global Chief Investment Officer of UBS and CEO of GAM Holding, a publicly listed asset manager. Alex co-founded the economic research platform Jackson Hole Economics and serves on the board of Franklin Templeton. He is based in New York.

Novata was designed to make sustainability simpler and more actionable. How does the platform work, and what kind of impact does it enable for investors and companies?

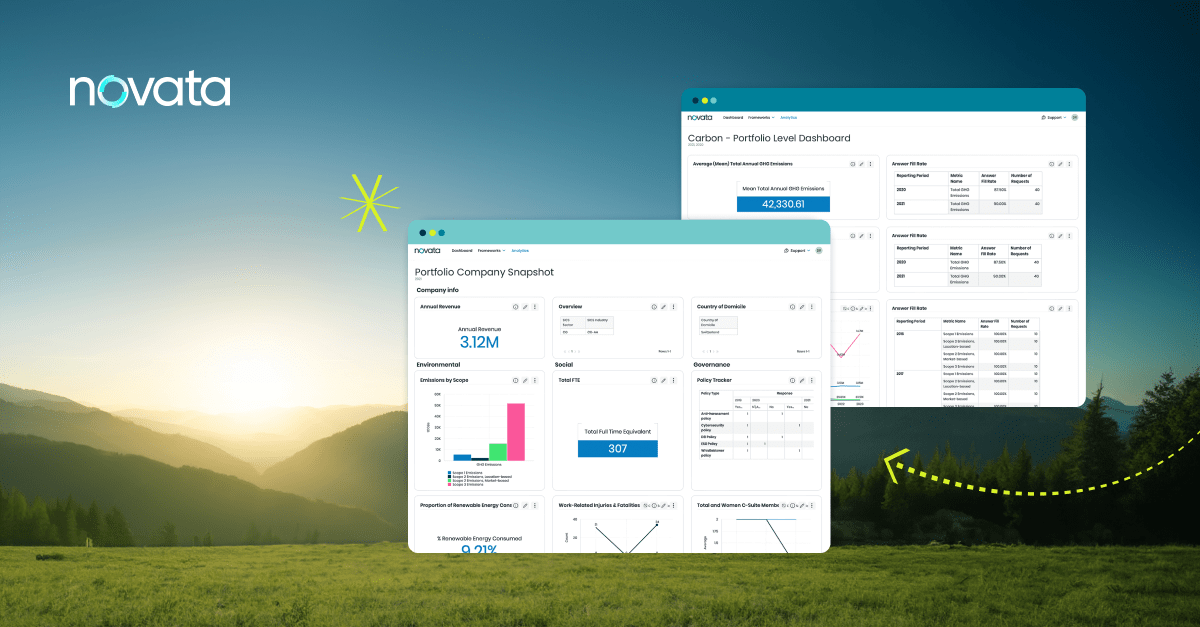

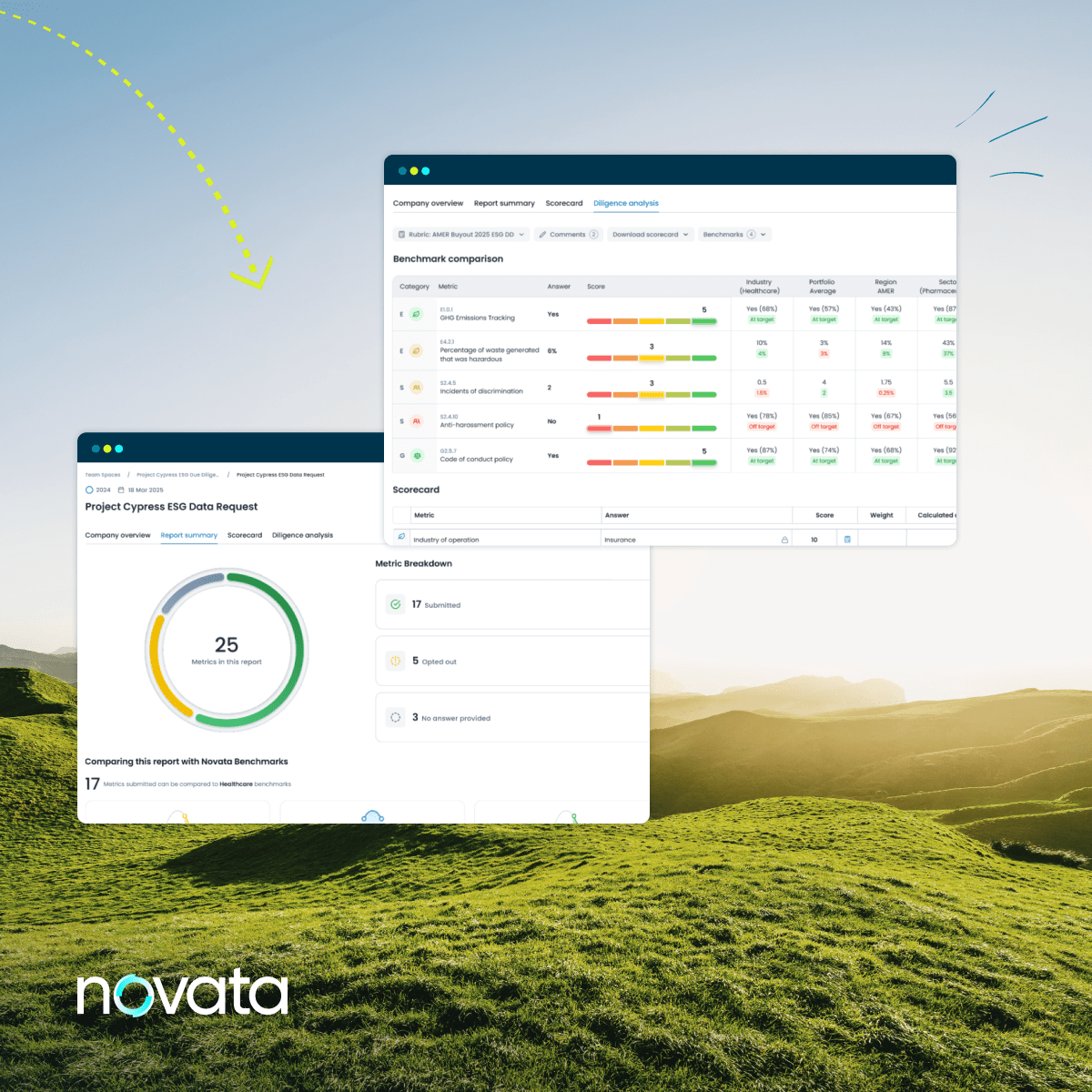

Novata helps private market investors and companies collect, analyze, and act on the sustainability metrics that matter most. Our platform streamlines ESG data collection, carbon accounting, and regulatory reporting through an intuitive, secure interface. Paired with expert advisory support, Novata meets our clients at every stage of their sustainability journey. The result? Higher-quality data, greater transparency, and more informed decision-making. This enables companies to operate more responsibly and investors to better assess risk and long-term value.

You’ve written that “ESG is dead — but its ideas are stronger than ever.” Can you unpack what you mean by that, and how that perspective informs your work at Novata?

What’s fading is the label “ESG,” which has become politicized and misunderstood. But the core ideas behind ESG (understanding a company’s environmental risks, how it treats people, and whether it’s governed responsibly) are central to managing long-term business risk and value. At Novata, we’re not chasing a trend. We’re helping private markets manage sustainability with the same rigor as financial performance. That means surfacing decision-useful data, integrating it into strategy, and aligning it with what stakeholders care about. The term may be under fire, but the work has never mattered more.

ESG data collection in the private sector can be challenging due to varying levels of readiness. And for topics like human capital or governance, numbers alone aren’t always enough. How does Novata balance quantitative metrics with the need for qualitative context?

We believe quality data starts with clarity and usability. Novata’s platform guides users through data input with built-in definitions and validations to reduce inconsistencies and improve accuracy. We also recognize that numbers alone don’t tell the full story, especially on topics like governance or workforce practices. That’s why we include space for qualitative context and structured commentary alongside metrics in the platform.

Novata’s benchmarks put data in context by showing our clients how their data compares to anonymized peers across the private markets. Our advisory team can also help clients interpret their platform insights and turn it into clear, data-driven narratives for stakeholder reporting and sustainability disclosures.

What’s next for Novata on the technical side? Are there any upcoming features, partnerships, or integrations aimed at enhancing the platform?

Novata is continuing to evolve to meet the growing demands of sustainability reporting in private markets. We’re investing in expanded AI capabilities to automate data validations, streamline bulk uploads, and extract ESG metrics from unstructured documents. These features will reduce manual work and improve data quality. We’re also developing dynamic dashboards, advanced benchmarking tools, and expanded portfolio-wide reporting exports. Recent launches, including our ESG Due Diligence solution and Microsoft partnership, reflect our momentum.

Our product roadmap is grounded in client feedback, ensuring we continue to deliver what private markets need most: practical, scalable, and trusted sustainability infrastructure.

Looking back at your journey - from the Gates Foundation to UBS to Novata - you’ve consistently been a proponent of responsible capitalism. What personal values or experiences have shaped how you approach sustainability and impact today, and what’s your advice for sustainability professionals?

I’ve spent much of my career at the intersection of finance, policy, and philanthropy. What I’ve learned is that the most durable systems—whether capital markets or organizations—are built on accountability and long-term thinking. At the Gates Foundation, I saw how data can drive action. At UBS, I saw how capital can shape behavior. Novata brings those lessons together. For sustainability professionals today, my advice is: Don’t wait for a perfect system. Start with what matters most to your stakeholders, build momentum with what you can measure, and never lose sight of the bigger purpose.

As the sustainability landscape continues to evolve, Alex Friedman and Novata are laying the groundwork for how private markets can lead with clarity, accountability, and impact. Thanks for reading and hope you enjoyed the interview - we’ll meet here again in two weeks. 🟢

Did you enjoy this interview? |

PARTNER WITH US

Increase your brand awareness and visibility by reaching the right audience and target market. Showcase your company, solutions, services, products, reports, surveys, events, or other content in front of our highly targeted audience of +4,500 Sustainability & ESG professionals. Contact us at [email protected] if you think we can partner in some way.